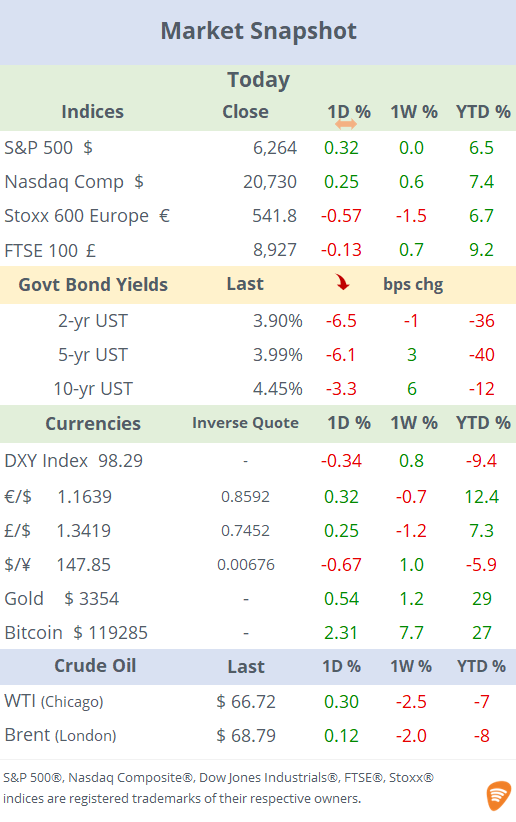

See the ‘Market Data’ post.

US indices finished slightly firmer on a busy day for data, earnings, and Trump-related headlines. The President denied that he is planning to fire Fed Chair Jerome Powell. Press reports that Trump had discussed with Republicans the dismissal of Powell sent stocks down by 0.8%, but they recovered later following his denial. In Europe, equities fell after ASML disappointed on guidance, pulling the EuroStoxx 50 index lower by 1%.

Treasury yields shifted down around 6bp across tenors, driven by uncertainty regarding Powell and a steep drop in producer inflation. June’s PPI decelerated sharply to 2.3% YoY, the lowest since September, suggesting tariffs aren’t yet feeding through broadly, a bullish sign for markets.

Economics: UK headline inflation for June came in at 3.6%, up from 3.4% in May and above estimates, marking the highest reading since early 2024. Core CPI also accelerated to 3.7%, exceeding expectations. 10-yr Gilts yield moved up to 4.64%, the highest close in four weeks. The Bank of England’s response, which meets on August 7, now depends on upcoming wage and jobs data.

On the earnings front, Goldman Sachs, Morgan Stanley and Bank of America beat top and bottom estimates for Q2 on solid trading and the volatility triggered after Liberation Day. Trading fees collectively climbed 17% at the five biggest Wall Street banks while dealmaking rose 7% during the quarter, with Goldman as the outperformer with profits up 22% to $3.72bn.

The bank set a new record for quarterly equity trading revenue, generating $4.3bn, a 36% increase from the same period last year. Morgan Stanley reported a 23% rise in stock trading revenue, citing “higher client activity” as a key driver. Bank of America also credited a 10% gain to strong performance and “increased client activity.”

Goldman shares ended marginally firmer and accumulated a 24% rally YTD, Morgan Stanley fell 1.3% and Bank of America finished almost unchanged. The Financials Sector ETF (XLF) advanced 0.7% today and is 7% higher this year, in line with the S&P 500.

Outside of the banking sector, Johnson & Johnson (mcap $396bn) and Dutch chip equipment maker ASML (mcap $258bn) also reported today and were the biggest movers on our Succinct 200 Universe.

Despite beating Q2 earnings and bookings expectations, ASML delivered a cautious outlook for the rest of 2025 and notably warned that growth in 2026 is not assured, pointing to macroeconomic and geopolitical risks. Shares plunged 8%. (CNBC)

J&J beat top and bottom estimates and raised its full-year outlook on a strong pipeline and tariff resilience, reassuring analysts. Shares gained 6%.

In commodities, EIA crude oil inventories for last week, released today, declined more than expected (-3.8mn barrels), and US crude stocks now sit ~8% below the 5-year seasonal average, a bullish signal. However, gasoline inventories rose sharply, limiting the impact on prices. WTI futures finished little changed at $66.70 on a volatile session.

Corporate deals: Apollo Global is in talks to acquire a minority stake in Atletico Madrid, Spain’s third-largest football club, to help it develop an €800mn real estate project. Private equity rival, Ares Mgt, controls 34% of the club’s parent holding. (FT)

In corporate credit markets, Britain’s Froneri International, the privately-owned ice cream giant known for the Häagen-Dazs brand, is close to pricing a €3.9bn seven-year junk debt offering to allow co-owner PAI Partners to keep its stake in the joint venture backed by Nestle via a >€4bn dividend payment. (Bloomberg)

IPOs: Canadian gold miner Aura Minerals (mcap $2bn) was uplisted to Nasdaq’s Global Market in addition to its main listing in Toronto. It raised ~$200mn at $24.25, and shares ended a touch lower while the Toronto line declined 7%.

Lastly, the central bank of Indonesia cut its policy rate (7-day reverse repo) by 25bp to 5.25% as expected, its fourth reduction since September. BI signalled additional cuts, assuming inflation stays low (at 1.8%, within target) and the rupiah holds steady.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.