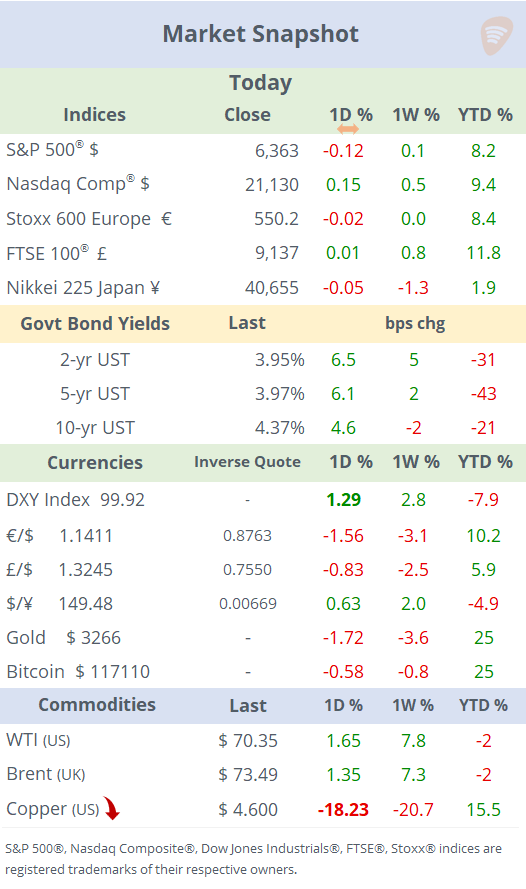

See the ‘Market Data’ post.

Good evening,

The drivers of market sentiment on Wednesday were the strong US GDP update, followed by the expected Fed decision to keep rates steady and Powell’s somewhat dovish press conference, but with no indication of a rate cut in September. Analysts were expecting more convincing signs that the Fed will reduce borrowing costs next month. The $ rallied during the press conference, stocks fell, Treasury yields rose, copper plunged today, and gold, silver and Bitcoin dropped. The most relevant earnings releases today came in after the close, with Microsoft and Meta Platforms beating estimates and rallying sharply in extended trading.

Tariffs: Trump imposed 50% levies on Brazilian imports, excluding orange juice, aircraft, iron ore and fuel products, coming into effect in seven days. He also announced a 25% levy on imports from India, but later said that negotiations were still ongoing. The notable mover was copper, which plummeted 19% today due to Trump's announcement that a 50% tariff will be imposed on semi-finished copper products such as pipes, wires, and cable fittings, but not on refined copper. This unexpected exclusion of refined copper from the tariffs led to a significant market reaction.

Monetary Policy: As widely anticipated, the Fed kept the rates steady between 4.25% and 4.5% for a fifth straight meeting, while assessing how importers, retailers, and consumers will share the burden of increased import levies. The central bank signalled cautious optimism amid mixed economic data and ongoing inflation concerns linked to tariffs. The decision was not unanimous as two FOMC officials out of 12 (Bowman and Waller) voted for an immediate 25bp rate cut. It was the first time in 32 years that more than one board governor dissented with the Fed Chair.

Powell’s post-meeting speech was mostly dovish but with no clear signs that the Fed will cut in September. He said that the tariff pass-through to prices may be slower than thought and that inflation is most of the way back to 2% with services inflation down nicely while goods are going up. However, inflation is further from the Fed’s goal than employment. Also, the next steps the Fed takes are likely to be closer to neutral (an interest rate level that neither stimulates nor restrains the economy).

The unexpectedly strong GDP update, released earlier today and Powell’s speech, led to a lower probability of a rate cut in September, with traders now pricing in a 45% chance for a 25bp rate cut.

Also, the Bank of Canada kept its benchmark rate steady at 2.75% as expected, for the third straight meeting, at a three-year low and signalled a potential cut if conditions soften.

Earnings: After the close, Microsoft and Meta Platforms both reported strong earnings, surpassing Wall Street’s top and bottom estimates, signalling robust demand for cloud and A.I. services, and stocks rallied 7% and 9% respectively, in extended trading.

In Europe, earnings delivered a mixed-to-negative tone today. While UBS stood out with strong results, HSBC (-4.5%) and autos like Mercedes-Benz (-3%) and Adidas underperformed, reinforcing concerns around tariffs and economic headwinds. Adidas (mcap €33bn) was the notable mover with an 11.5% decline to accumulate a 26% loss this year. Although it posted a 58% jump in Q2 operating profit (€546mn), sales missed expectations, and it flagged a €200mn tariff hit in H2.

Economics: US Q2 real GDP rose 3.0% annualised, much stronger than expectations and rebounding from a 0.5% contraction in Q1. It’s also the highest reading since early 2024. Although consumer spending increased, it was offset by weaker business spending, which offered mixed signals.

Abroad: EU’s GDP expanded in Q2 by 1.4% YoY, a modest acceleration from Q1. Germany’s retail sales rose 4.9% YoY, the strongest month since Feb 2022. Australia’s CPI rose by 2.1% YoY, the lowest inflation since March 2021.

Corporate deals: In Silicon Valley, Palo Alto Networks (mcap $123bn) will acquire CyberArk Software (mcap $22bn, HQ in Israel) in a $25bn cash-and-stock deal. CyberArk shares have rallied 15% since Monday’s close when the news first broke. Palo Alto dropped ~5% today.

Harley-Davidson (mcap $3.2bn) is reportedly close to selling a major stake in its finance unit, HDFS, and its motorcycle loan portfolio in a deal worth about $5bn. Shares jumped 16% today but remain 12% lower YTD.

In Europe, Italian aerospace & defence leader Leonardo Spa (mcap €27bn) is acquiring Iveco’s defence unit (Iveco Defence Vehicles) for €1.7bn as part of a broader breakup of Iveco Group (mcap €5bn) alongside Tata's acquisition of the commercial vehicle business.

In Japan, Swedish private equity firm EQT has launched a $2.7bn tender offer to take Tokyo-listed elevator maker Fujitec Co private by acquiring an 85% stake while the founding family retains 15%. Shares fell 10% on Wednesday.

In IPOs, Black Rock Coffee Bar has filed confidentially for an equity offering in New York that could value the cafe chain at >$1bn.

Day ahead: the Bank of Japan holds a policy meeting (unch 0.5$ exp); inflation updates in the US (PCE) and Europe (HICP).

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.