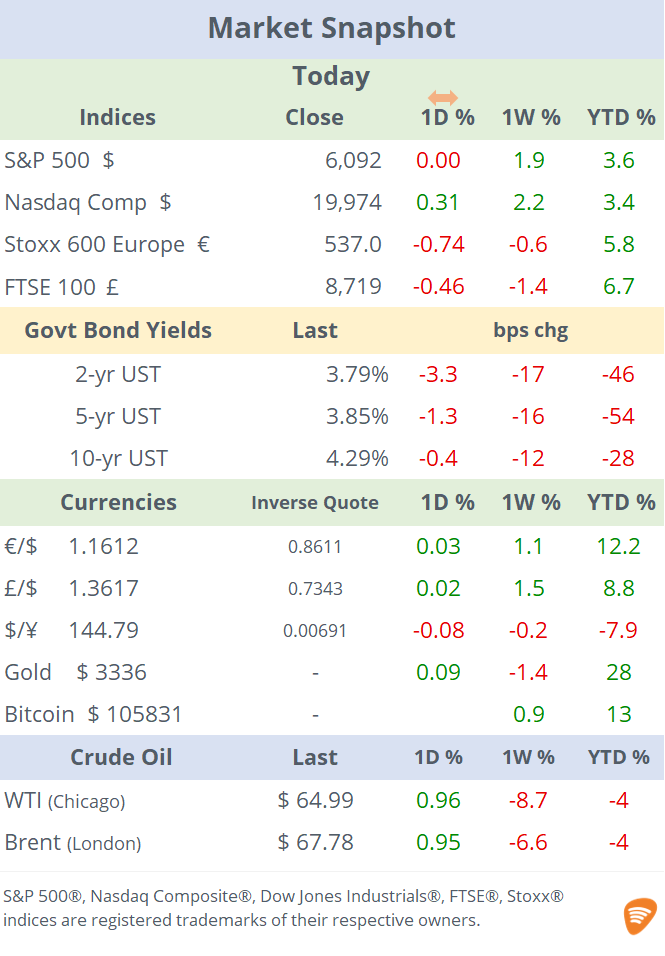

See the Market Data post.

Good evening,

With the Israel–Iran truce holding, markets had a relatively calm Wednesday while Trump flies to The Netherlands to attend the NATO Summit. Leading US stock indices ended mixed and little changed, still very close to their record highs. The exception was the small-cap sector with the Russell 2000 losing over 1% as investors rotated out of the sector and into large caps mainly driven by hawkish comments by Fed Chair Powell regarding the interest rate outlook.

At his second-day testifying before Congress, Powell said that the Fed needs to manage inflation risks and that tariffs could well lead to more persistent inflation beyond an initial jump. He did acknowledge that recent data would likely have justified a rate cut. Bond yields finished steady today and maintained their downward trend with most of the yield curve shifting down by 15bp in the past week.

It was a light day in economic data with new single homes sales in the US missing estimates and dropping the most since 2022 to a 7-month low of 620k units driven by higher mortgage rates and rising economic uncertainty.

Keep reading with a 7-day free trial

Subscribe to U.S. Markets Daily to keep reading this post and get 7 days of free access to the full post archives.