Wed 21 May: After the Bell

See the ‘Market Data’ post.

Good evening,

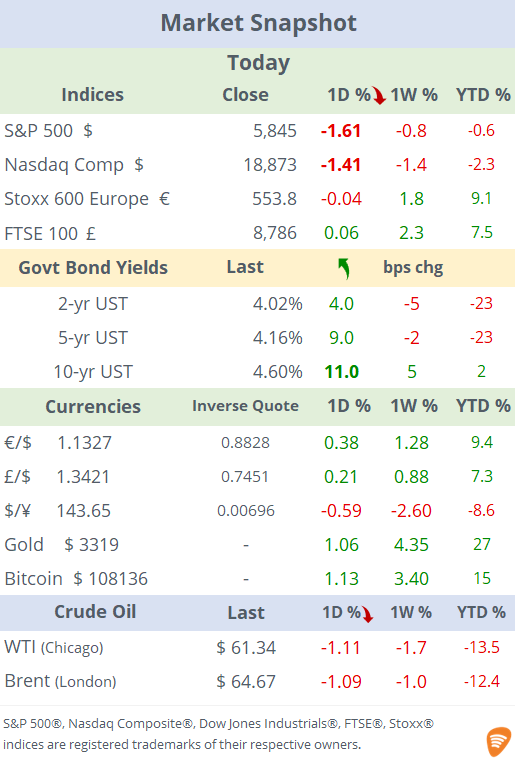

Investor sentiment is being driven by progress on Trump’s flagship tax bill. The worsening of the fiscal outlook was reflected on a weak Treasury auction and a sell-off in bond and stock markets. US government bond yields have been shifting upwards during May, with 30-yr bonds now yielding over 5%. Today’s 20-yr bond auction ($16bn) was priced at 5.1%, the highest yield since October 2023. Also, 30-yr mortgage rates traded above 7%.

US equities fell sharply on Wednesday with the S&P 500 down 1.6%, the Dow Jones losing nearly 2% and the small-cap Russell 2000 plunging 2.8%. The VIX volatility index added almost 3 percentage points to 20.8%, the highest in 10 days. The DXY $ index fell below 100 points as the greenback lost ground against all major currencies. Gold and Bitcoin gained ~1% today.

It was also a volatile day for crude oil with a rally in European trading time as reports suggested that Israel is planning to target Iran’s nuclear facilities followed by a reversal during Chicago hours after the US government released bearish data on inventory. Crude (+1.3mn bbl), gasoline (+0.8mn bbl) and distillate (+0.6mn bbl) stocks posted a surprise increase last week, according to the EIA. Both Brent and WTI futures finished 1% lower today and accumulated a 13% fall YTD.

Economics: in the UK, headline inflation in April grew 3.5% YoY, the highest in 15 months and significantly more than the 2.6% in March. The main catalysts were higher utility bills and tax increases. Services inflation accelerated even faster, up 5.4% YoY (vs 4.7% prior). Core CPI inflation came in at 3.8%, also rising. Traders are pricing in only one policy rate cut by the BoE during the next 12 months.

Deals: AI-devices start-up IO, founded by Jony Ive, Apple’s former designer, is being acquired by OpenAI, ChatGPT’s parent for $6.4bn in stock, increasing its bet on alternatives to smartphones. (BBG)

Also, AT&T is acquiring the consumer fiber operations of Lumen Technologies (mcap $4bn) for $5.7bn. Lumen shares jumped 16% in after-hours. (AT&T)

In private equity, Blackstone began searching potential buyers for its British trade show events company Clarion Events, which it bought in 2017. With an estimated EV of £2bn it could become the largest PE exit of the year.

IPOs: Chinese battery maker CATL, began trading in Hong Kong, adding another line to its mainland listing. It raised $4.6bn and is valued at $166bn. (FT)

Earnings: Target (mcap $42bn) delivered weaker-than-expected results. It missed revenue and net income estimates and cut its outlook due to the tariff’s situation. Shares fell over 5% to the lowest level in 5-yrs. Also, retailer TJX Companies, beat top and bottom-line estimates and maintained its full-year sales forecast but warned of the potential impact of tariffs and shares fell >3%.

Large caps reporting earnings on Thursday include: Intuit, Analog Devices, Copart, Workday and Autodesk. In data releases, we’ll get US existing home sales and PMIs in most developed countries.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.

S&P 500®, Nasdaq 100®, Dow Jones Industrials®, FTSE®, Stoxx® and other indices are registered trademarks of their respective owners.