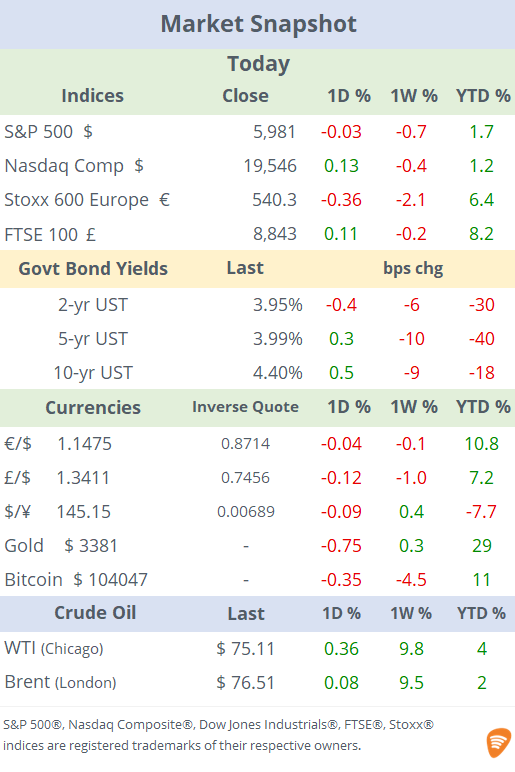

See the ‘Market Data’ post.

Good evening,

Markets were little changed on Wednesday with minimal moves across asset classes. Equity indices, benchmark interest rates and currencies finished almost unchanged ahead of tomorrow's US holiday and on a Fed meeting day. On the war front, Trump is considering Washington’s options including a strike on Iran after saying that Tehran should have made a nuclear deal earlier. Israel and Iran have continued to exchange fire with Tel Aviv managing to prevent Iran’s missiles from even departing their territory with a control of the airspace.

As widely anticipated, the Fed kept its policy rate steady at a 4.25% to 4.50% range, and the FOMC’s dot plot forecasts two rate cuts of a quarter point each before year-end. Trump is pushing Powell, after calling him ‘stupid’, to cut rates by 200bp. The Fed president said that tariffs will likely lift prices and slow the economy, and the central bank cut its outlook for growth to 1.4% for 2025, with unemployment rising to 4.5%, and PCE inflation to accelerate to 3%. Fed officials are waiting to see if companies translate higher costs from tariffs to prices or reduce their profits. Analysts see the Fed in a difficult situation as inflation has decelerated but has not reached the Fed’s 2% target, after four years running above the goal. Easing policy too soon could risk reigniting price pressures and delaying the reduction of rates could trigger a recession.

In economic data, UK inflation rose as expected, +3.4% YoY, its second month this year with a reading above 3%. House prices fell at the fastest pace in four years in April (+3.5% YoY) as the temporary tax relief ended.

In commodity markets, the notable mover today was Wheat with front-month futures advancing >4% driven by multiple factors including worsened crop conditions with excessive moisture affecting the winter harvest in Kansas and Oklahoma as well as war conflicts in Ukraine and the Middle East.

In corporate deals, in the European banking sector, Spanish Sabadell (mcap €14bn), which is under a takeover approach by larger rival BBVA (mcap €75bn), is putting its UK subsidiary, TSB, for sale. Barclays, NatWest, HSBC and Santander UK are among the interested bidders. TSB is estimated to be valued at ~€2bn which would give Sabadell a €200mn capital gain. Sabadell shares gained 50% YTD.

In IPOs, Texas-based Caris Life Sciences (CAI), a leading next-generation AI tech bio company, raised $494mn, was priced at $21, above the guidance range, and gained 33% to $28 on its debut day on Nasdaq for a market cap of $8bn.

Day ahead: markets will be closed in the US on Thursday. Tomorrow’s publication will be subject to moves in international markets.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.