See the ‘Market Data’ post.

Good evening,

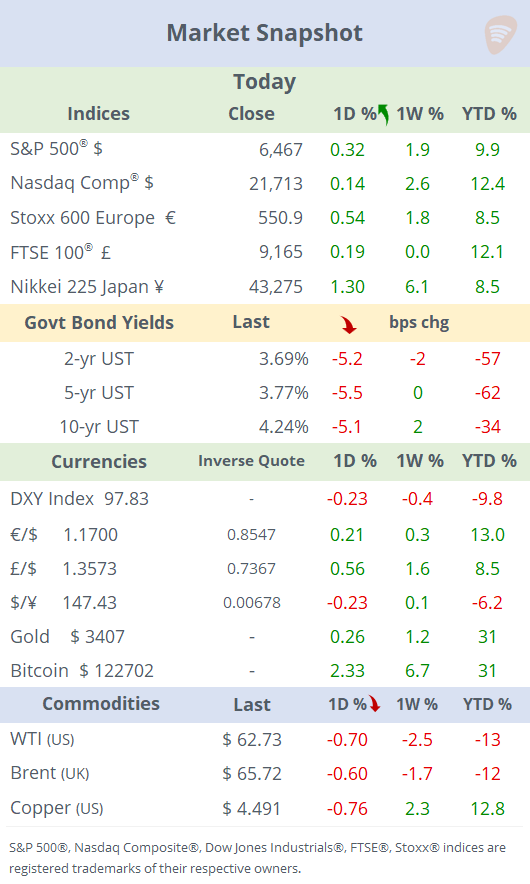

The bullish trend in equities extended to fresh records, with the Dow and the small-cap Russell 2000 outperforming, each gaining over 1%. The Nasdaq Composite and the S&P 500 posted modest advances on Wednesday but have accumulated ~2% gains over the past week, while the Nasdaq 100 index is already up 13.5% YTD.

Bond yields maintained their downward trend, with the entire Treasury curve shifting lower by ~5bp as traders increased their bets on a Fed rate cut at the September 17 meeting, pricing in a 94% chance of a 25bp cut and a 6% chance of a 50bp reduction.

This dovish tone pulled the DXY dollar index below 98, as the greenback fell mainly against the pound. Gold traded little changed at $3,400; Bitcoin gained over 2% to a new historic high of $122,700; and crude oil prices remained weak, with WTI below $63, down 2.5% over the past week.

In geopolitics, Trump told European leaders during a constructive videoconference call, he will not negotiate territorial issues at Friday’s Alaska meeting with Putin, focusing instead on securing an immediate cease-fire. The President also warned Putin of “very severe consequences” if he refuses a cease-fire.

It was a quiet day on the economic front, with no notable data releases.

Earnings: Cisco Systems (mcap $280bn) reported after the bell; it closed 1.5% lower on regular trading hours and fell ~3% more in extended trading following a lukewarm outlook despite marginally beating estimates.

Chinese online giant Tencent (mcap $690bn) beat top and bottom estimates, delivered strong Q2 results, powered by growth in gaming, AI-driven marketing, and heavy reinvestment in AI infrastructure. Shares advanced almost 5% in Hong Kong to accumulate a 40% gain YTD.

Germany's energy leader E.On (mcap €42bn) reported an increase in adjusted profit for H1’25, a 13% YoY rise in EBITDA and reaffirmed its full-year earnings guidance. Shares finished slightly firmer today but are 42% higher YTD.

Corporate deals: Apollo has agreed to acquire a majority stake in Germany-based cooling equipment maker Kelvion, owned by private equity firm Triton, which will retain a minority interest, in a transaction valued at ~€2bn.

Canada’s Gildan Activewear (mcap $8bn), a manufacturer of basic apparel, has agreed to acquire U.S.-based HanesBrands in a $2.2bn cash-and-stock deal (valued at ~$4.4bn including debt), combining its low-cost manufacturing scale with Hanes’ well-known brands like Hanes and Maidenform. HanesBrands' stock rallied 33% this week while Gildan gained ~10%.

Israeli software firm Sapiens International (mcap $2.4bn) will be acquired by Advent International in a $2.5bn all-cash deal, as the U.S. private equity giant targets the insurance sector amid accelerating adoption of AI technologies. Shares jumped 44% and are 58% higher YTD.

KKR plans to launch the £7bn sale of UK-based recycler and waste management group Viridor next month, five years after acquiring it for £4.2bn from Pennon Group, with potential bidders including Brookfield, Equitix, and CKI amid strong demand for infrastructure assets.

In IPOs, Bullish (BLSH), the crypto exchange behind CoinDesk, raised $1.1bn, was priced at $37, well above its guidance range, for a total market value of $5.6bn. Bullish had a strong debut today with a 162% gain to $97.

Day ahead: GDP in the UK and producer prices in the US; and on the earnings front, Alibaba, Applied Materials, Deere & Co, Foxconn and JD.com.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.