See the ‘Market Data’ post.

The latest in tariffs negotiations in London, include a framework by Washington and Beijing negotiators to restore a trade truce and de-escalate tensions. China agreed to supply rare earths while the US will allow Chinese students visas. Commerce Secretary Lutnick said “I feel really good about where we got to”. Trump confirmed today that the deal with China to restore the trade cease-fire was done, subject to final approval from both presidents.

Tensions between Trump and Elon Musk also eased after Musk walked back some attacks on the President following a phone call and posted an apology.

Today’s key economic release was May’s headline consumer inflation which rose slightly to 2.4% YoY, above estimates and following April’s 2.3% print which was the lowest in four years. The core CPI reading, which excludes food and energy, rose 2.8%, a touch below expectations. This tame inflation update confirmed that Trump’s tariffs have not yet translated into higher prices.

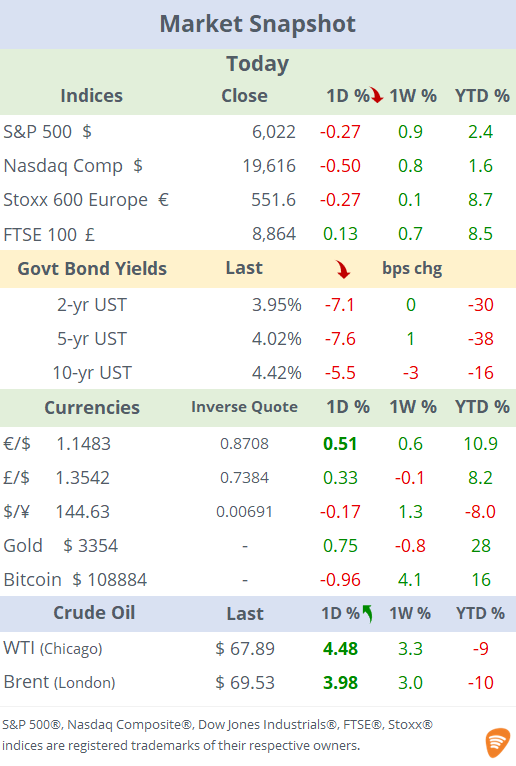

The release was followed by a post by Trump highlighting the great numbers and calling on the Fed to cut rates by a full percentage point. Treasury bond yields fell sharply with the short-end outperforming as yields on 2 and 3-yr bonds fell 8bp to sub 4%. The $ index fell below the 99-point level to its lowest in 3 weeks.

In equity markets, all leading US benchmarks finished marginally weaker today with the Nasdaq Composite falling 0.5%and the energy sector as the clear outperformer driven by a rally in crude oil. WTI gained 4.5% to almost $68 on the back of the positive news on the trade truce and the EIA weekly update which showed a drop in inventories (by 3.64mn barrels), much more than anticipated and the third week of decline.

In earnings releases today, Oracle (mcap $495bn) beat top ($15.9bn, +11% QoQ) and bottom ($3.43bn, +9% YoY) estimates after the close and signaled that cloud growth is accelerating. Shares gained 6.5% in extended trading to the highest level since February. (Yahoo)

In Europe, Spanish fast fashion giant Inditex (mcap €146bn), Zara’s parent, surprised analysts with a miss for both, sales (€8.27bn, +1.5% YoY) and earnings (€1.3bn, +0.8% YoY) estimates, as it faces challenges from tariffs and increasing competition by low-cost Chinese platforms. Shares fell 4% and are down 5% YTD. (CNBC)

In IPOs, defense technology and space solutions Voyager Technologies (VOYG) raised $383mn, was priced at $31 and shares rallied 85% on their Nasdaq debut for a market value of $2.8bn. (MW)

In upcoming IPOs, Caris Life Sciences (CAI), a precision oncology firm is targeting a valuation of up to $5.3bn as it plans to raise $423mn in its Nasdaq listing next Wednesday. The indicative price range is $16-18. (Reuters)

In private markets in the UK, KKR and Stonepeak Partners raised their bid for Assura Plc (mcap £1.6bn), the british healthcare property manager to almost £1.7bn. Assura shares advanced 2% today and accumulate a 30% rally this year.

Data and earnings to be released on Thursday: US producer inflation and jobless claims, UK GDP, India inflation and Adobe Inc (software, mcap $176bn) reports results after the close.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.