Mon 19 May: After the Bell

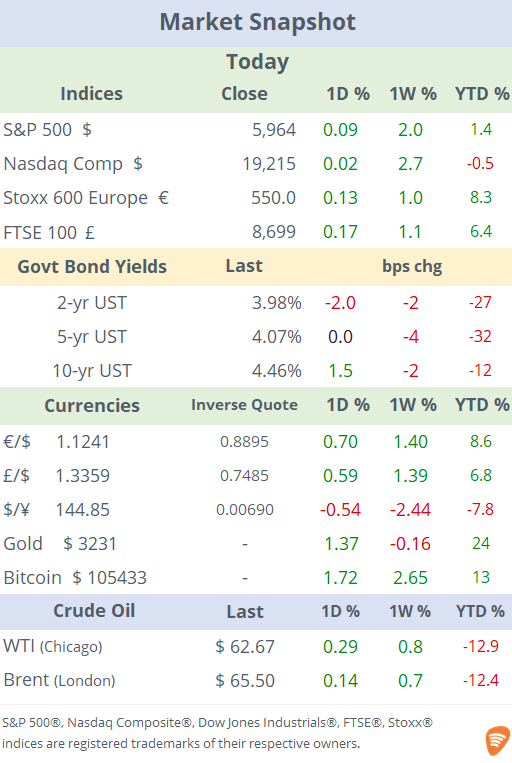

See the ‘Market Data’ post.

Good Evening,

Stocks opened around 1% lower on Monday following Moody’s rating downgrade of the US debt after the close on Friday to Aa1 (from Aaa), citing large fiscal deficits and increasing interest rates. But indices fully recovered during the day to end little changed. S&P Ratings and Fitch Ratings had already cut America’s rating from triple-A in 2011 and 2023. On Sunday, Republicans moved forward with Trump’s ‘beautiful tax and spending bill’ which worsens the country’s fiscal situation. The bill still needs house and senate approval to pass. (WSJ)

The biggest impact was felt on long-term Treasury yields which traded above 5% for the first time since October 2023 before easing and closed at 4.92%. The $ fell against all major currencies and the DXY Index is still down 7.5% YTD.

In equities, the Dow Jones Industrials index rose the most (+0.3%) driven by UnitedHealth’s 8% rally on the back of insiders buying the stock while other benchmarks ended mostly flat on the day.

On the geopolitical front, Trump and Putin held a long conversation leading to Trump’s announcement that ceasefire talks between Moscow and Kiev will begin immediately and result in the end of the war. (FT)

There were no major economic releases in developed markets. China reported figures that reflect the growth challenges it faces. Industrial production rose by 6.1% YoY, better than expected but slower than the previous month and retail sales advanced 5.1% YoY, worst than anticipated and lower than last month.

In corporate deals, TXNM Energy is being acquired by Blackstone Infrastructure for $5.7bn in equity value ($61.25/sh) or a 16% premium and $11.5bn of EV. TXNM shares gained 7% to an all-time high. In distressed deals, giant Regeneron Pharma (mcap $64bn) will take over bankrupt genomics firm 23andMe for $256mn. In the mining sector, giant Rio Tinto (mcap $105bn) is investing $900mn for a 50% stake in a Chilean lithium project (Maricunga) to add to its recent expansion in lithium mines in the US and Argentina.

Australia’s central bank holds a policy meeting tomorrow with rates expected to be cut by 25bp to 3.85%.

The US large-caps reporting earnings on Tuesday are Home Depot and Palo Alto Networks.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.

S&P 500®, Nasdaq 100®, Dow Jones Industrials®, FTSE®, Stoxx® and other indices are registered trademarks of their respective owners.