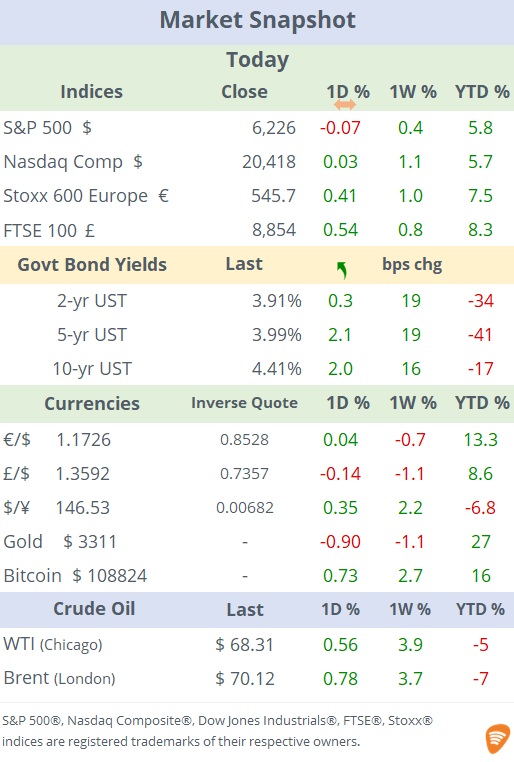

See the ‘Market Data’ post.

Good evening,

Updates on tariffs following a cabinet meeting in Washington are shaping sentiment, though equity, bond, and currency markets remained relatively subdued today. Tuesday’s focus was on commodity markets, particularly on base metals.

Copper prices in US exchanges jumped to an all-time high, gaining 9% after Trump announced a 50% tariff on imports. The key metal, used for electrical wiring and engines among other things, posted its biggest one-day rally in almost six decades and accumulated a year-to-date increase of 38%.

In April, the White House signaled that tariffs were being considered for copper and pharmaceuticals, under a law that allows Trump to apply tariffs on certain goods based on national security. The US will soon introduce levies of up to 200% on pharmaceuticals but the sector will have up to 18 months to relocate their supply chains before they’re implemented.

Also, Trump reiterated today that BRICS countries, Brazil, Russia, India, China and South Africa, will pay and additional 10% tariff charge.

In US stocks, the renewable energy sector fell sharply after the President issued an executive order calling for tighter application of the eligibility rules for clean-energy tax credits. First Solar (mcap $17bn) dropped 6.5%, giant NextEra (mcap $149bn) lost 3% and Sunrun (mcap $2.2bn) declined 11.4%.

Another big mover was Intel (mcap $103bn) with a 7% rally after it announced it began cutting jobs in Oregon. The chip maker is aggressively reducing costs after falling behind its rivals, lossing market share to AMD and Arm Holdings.

In central bank action, the Reserve Bank of Australia unexpectedly held rates at 3.85%, defying widespread expectations for a 25bp cut amid weak growth, easing inflation, and global trade concerns. Only 3 out of 9 voting members opted for a rate cut.

“With the cash rate 50 basis points lower than five months ago and wider economic conditions evolving broadly as expected, the Board judged that it could wait for a little more information to confirm that inflation remains on track to reach 2.5% on a sustainable basis,” the RBA stated.

There were few corporate deal announcements today. Samsung Electronics (mcap $295bn) of South Korea acquired Xealth, a privately held US healthcare integration platform with a network of more than 500 hospitals, to expand its mobile healthcare service business, for an undisclosed amount. Samsung also said it projects Q2 operating profit to more than halve YoY, a much steeper drop than analysts’ estimates, due to US trade curbs on China. Samsung shares are 15% higher this year.

Another private deal to highlight is CVC Capital and Apollo’s interest to acquire DSM-Firmenich’s (mcap €24bn, Swiss-Dutch) animal nutrition division, for an estimated €3bn.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.