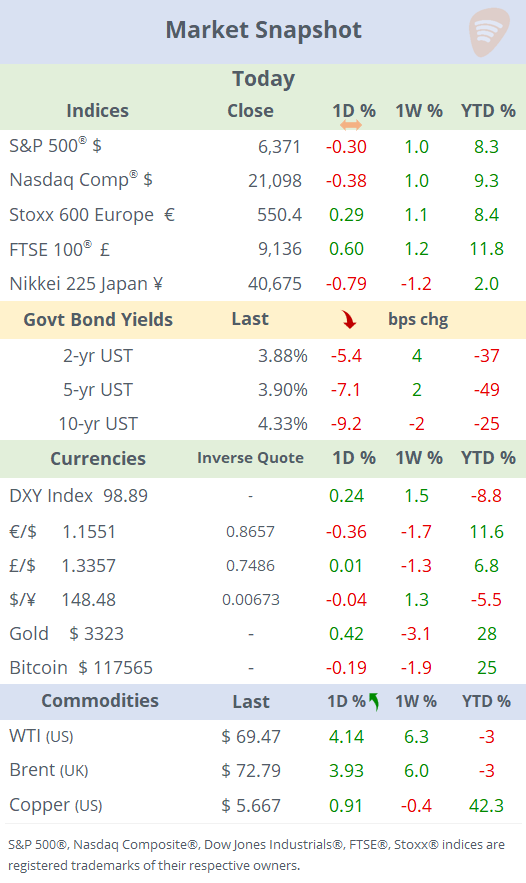

See the ‘Market Data’ post.

Good evening,

It was an active session for earnings, tariff headlines, and geopolitical updates. Yet risk assets finished only slightly weaker, showing resilience despite the noise.

Treasury bond yields, especially the long-end, fell sharply today, driven by heightened risk-off sentiment as markets absorbed a mix of tariff uncertainty, rising geopolitical tensions, and caution ahead of tomorrow’s Fed meeting. The 30-year bond yield declined 10bp to 4.86%. US stock indices slipped modestly in a mixed session, with sector moves split between clear gainers and losers. In Europe, stocks recovered from Monday’s selloff.

Geopolitical risk tension resurfaced as Trump cut his ceasefire deadline for Russia, now giving Putin 10 to 12 days to secure peace in Ukraine or face harsh sanctions and secondary tariffs. Moscow acknowledged the statement but dismissed it, with Medvedev warning that issuing ultimatums risks escalating toward a broader conflict. This explains the 4% jump in crude oil prices today to the highest level in five weeks.

On the tariffs front, the agreement between the US and the EU sets a 15% levy on 70% of EU goods — half the level of Trump’s threat on Liberation Day, but still three times higher than existing tariffs and the highest in decades.

US and Chinese officials held constructive talks on extending their tariff truce, which expires on August 12, but no deal was reached. A three-month extension is under consideration, pending Trump’s decision.

Notable stock movers: Danish pharma giant and one of Europe’s largest companies, Novo Nordisk (mcap $250bn), plunged as much as 30% today before a partial recovery to end 22% lower, its lowest level in 3-yrs, after a profit warning and major guidance downgrade (its second YTD) with full-year cuts to sales growth and operating profits as its obesity and diabetes drugs Wegovy and Ozempic face softer US demand, slower international uptake, and intensifying competition.

US Earnings: Overall sentiment was cautious to negative today, with UnitedHealth (-8%), UPS (11%) and Spotify (-12%) missing expectations, while PayPal (-9%) beat on headline numbers but disappointed on key metrics. Procter & Gamble (mkt cap: $367bn) beat estimates ($3.6bn profits on $21bn revenues in Q2) but shares barely moved today. The highlight of the report was a plan to raise household product prices by around 5% to offset the impact of tariffs, illustrating how trade policy is feeding through to consumer inflation.

Companies reporting after the close: Visa and Booking Holdings shares fell ~2% in extended trading despite beating estimates, while Starbucks gained 3% despite missing profit expectations. (CNBC)

Corporate Deals: Union Pacific (mcap $131bn) and Norfolk Southern (mcap $62bn) will merge to create a coast-to-coast rail operator giant in the biggest M&A deal of the year. Combined, their enterprise value adds up to $250bn and the market value to $193bn. Terms: one UNP stock plus $88.8 in cash (70%/30%) per NSC share. Shares of both companies fell 3% today. (Barron’s)

In the oil & gas sector, Baker Hughes (mcap $45bn) will acquire Chart Industries (mcap $9bn, industrial gas and liquids treatments) in a $13.6bn cash deal that beats a previous agreement to merge with Flowserve (mcap $7bn). Chart shares jumped 15% to a five-month high. (Bloomberg)

Ireland-based building materials company CRH (mcap $65bn) agreed to acquire Eco Material Technologies for $2.1bn from private equity firms to expand its presence in North America. (Reuters)

There were no notable IPOs today.

Finally, the Fed concludes its two-day meeting tomorrow, with the rate decision scheduled for 2 PM Eastern Time, followed by Jay Powell’s press conference. Markets widely expect the Fed to keep the target rate unchanged (4.25-4.5%).

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.