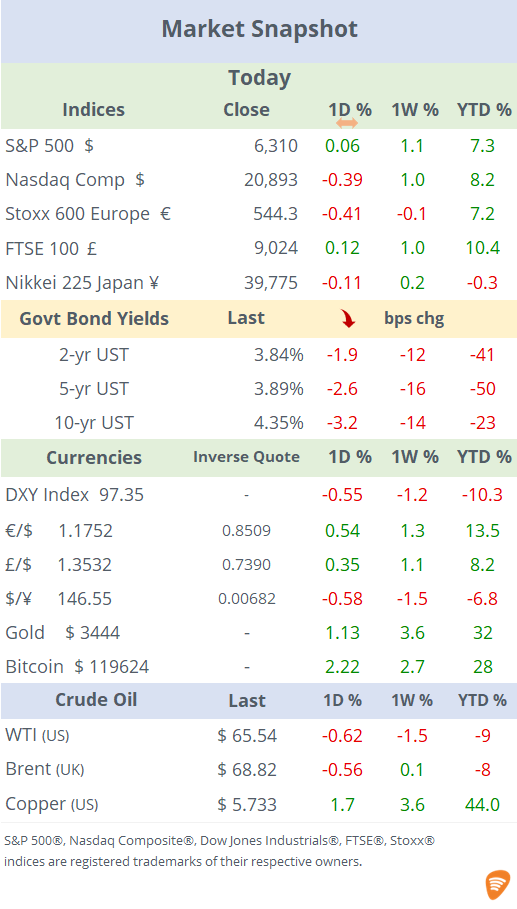

See the ‘Market Data’ post.

Good evening,

Markets traded mixed on Tuesday, with the $ maintaining its depreciation trend, and Treasury bond prices remained firm while stock indices finished unevenly. The S&P 500 ended marginally higher at a new record; the Dow Jones, small and mid-cap benchmarks gained, but tech stocks pulled the Nasdaq lower. It was another active day for earnings releases ahead of tomorrow’s reports by mega-caps Tesla and Alphabet after the close.

The White House reached trade pacts with the Philippines and Indonesia (19% levy on imports vs 0% for US exports) ahead of the Aug 1 tariff deadline. The Trump administration intensified its criticism of the Fed, as Treasury Secretary Bessent called for a whole review of the central bank’s non-monetary operations, including the spending on building renovations. Bessent said he sees no reason for Powell to step down as Chair, for now.

Today’s earnings releases reflected a mixed to cautious tone. While some sectors showed resilience, notable policy headwinds, especially trade tariffs, prompted investor unease in key industrial and manufacturing plays (Lockheed Martin and GM). Global trade tensions continue to weigh on market confidence, leading some companies to maintain guidance but with a warning on future pressures.

Aerospace & defence giant Lockheed Martin Corp (mcap $97bn) plunged 11% to the lowest level since Feb 2023, after missing both revenue ($18.1bn, 0% YoY) and earnings ($342mn, -80% YoY) estimates for Q2. Lockheed significantly cut its full-year profit outlook (-20%) but maintained its sales forecast ($74.25bn). The stock has accumulated a 15% loss YTD. Rival Northrop Grumman (mcap $81bn) beat top and bottom estimates, raised full-year guidance and saw shares rally over 9% to a record high.

General Motors (mcap $47bn) met quarterly expectations and affirmed its full-year guidance but flagged a persistent headwind from tariffs, raising concerns about future profitability and prompting capex shifting toward gas-powered vehicles. Shares plummeted 8%.

Two heavily shorted US stocks are experiencing a fresh wave of meme-stock mania with retail speculators aiming to profit from a short squeeze. The massive rally of Kohl’s Corp (+40% today, mcap $1.6bn) and Opendoor Technologies (+185% WTD, mcap $2.1bn) is purely retail-driven momentum, fueled by chatter on social media platforms, classic meme stock behaviour.

Jerome Powell’s speech today deliberately avoided any mention of interest rates, inflation forecasts, or future rate moves, consistent with the Fed’s “blackout” period ahead of next week’s meeting. His remarks were purely about banking regulation and the bank capital framework.

Corporate deals: French pharma Sanofi (mcap €102bn) is acquiring UK biotech Vicebio (private) for up to $1.6bn to expand its respiratory vaccine portfolio after facing pipeline setbacks.

Finally, US private investment firm CC Capital Partners agreed to acquire Australian wealth manager Insignia Financial (mcap $1.9bn) for $2.15bn in cash (terms: AUD 4.80/sh).

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.