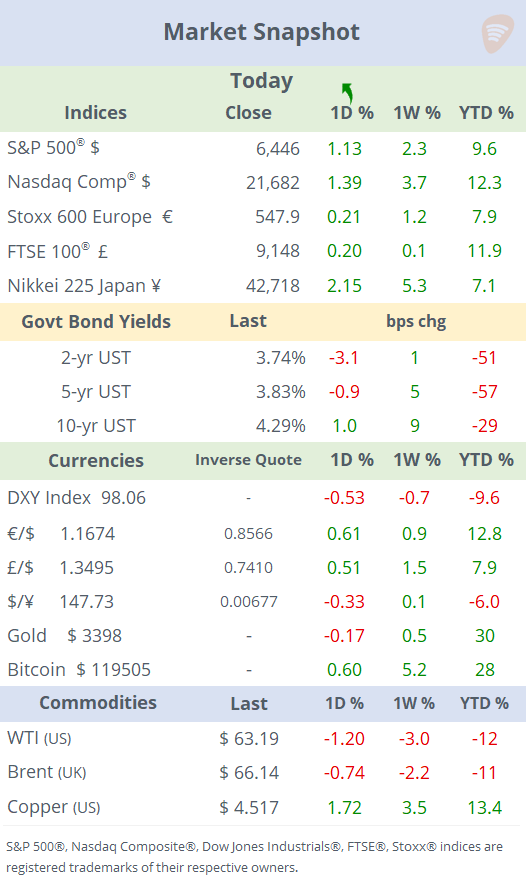

See the ‘Market Data’ post.

Good evening,

Risk assets rallied after a stable US inflation report fueled hopes of interest rate cuts. Leading stock indices gained over 1% to all-time highs, with the small-cap benchmark Russell 2000 adding 3% as the probability of a Fed rate cut in September gains momentum. Every US equity sector ended firmer on Tuesday.

The Treasury curve steepened as short-end yields fell around 3bp while long-end yields shifted modestly higher with 30-yr yields at 4.88%. The $ depreciated mainly against the Swiss Franc, € and £, with the DXY index trading around 98 the figure.

On the commodities front, the energy complex was particularly weak, with crude oil dropping over 1% and US natural gas losing over 5%. The Energy Information Administration released its updated oil price forecasts today and, in its August Short-Term Energy Outlook, it projects that Brent crude oil prices will average below $60 per barrel during Q4’25, marking the first sub-$60 quarterly average in 5 years. The expected decline is attributed to global oil supply growth significantly outpacing the rise in demand.

Data: US consumer prices rose 2.7% YoY in July, matching June’s pace and slightly below the 2.8% forecast. Core inflation, excluding food and energy, accelerated to 3.1% YoY, the fastest since January, driven by higher costs in services like housing and transportation. Futures traders increased their bets for a 25bp Fed cut to 4.125% mid-rate next month to 94% from 86% yesterday.

Also, Brazil’s annual inflation eased to 5.23% YoY in July from 5.35% in June, but remained above the central bank’s 3% target and the average of the LTM.

Central Banks: The Reserve Bank of Australia cut its benchmark lending rate by 25bp as expected to 3.60%, a more than two-year low, as Q2 inflation eased to 2.1%, the lowest since March 2021 and near the bottom of its 2–3% target range. The RBA downgraded its 2025 GDP forecast to 1.7% from 2.1% and struck a cautiously dovish tone, with markets expecting at least one more cut this year.

Deals: AI startup Perplexity has made an unsolicited $34.5bn all-cash bid for Google’s Chrome browser, funded by venture investors, nearly double its own valuation, as a potential remedy amid ongoing antitrust scrutiny of Alphabet.

Cardinal Health (mcap $35bn) will acquire privately-owned Solaris Health in a $1.9bn all-cash deal to gain access to 750+ urology providers. Cardinal also reported earnings today, missed revenue estimates and beat on profits. Shares fell 7% today despite raising its 2026 outlook.

US financial software provider MeridianLink (mcap $1.5bn) will be taken private by Centerbridge Partners in a $2bn deal, about four years after its IPO. Shares jumped 24% on Monday when the deal was announced.

Day ahead: Tencent, Cisco (AMC), E.ON are among the large caps reporting tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.