See the ‘Market Data’ post.

Good evening,

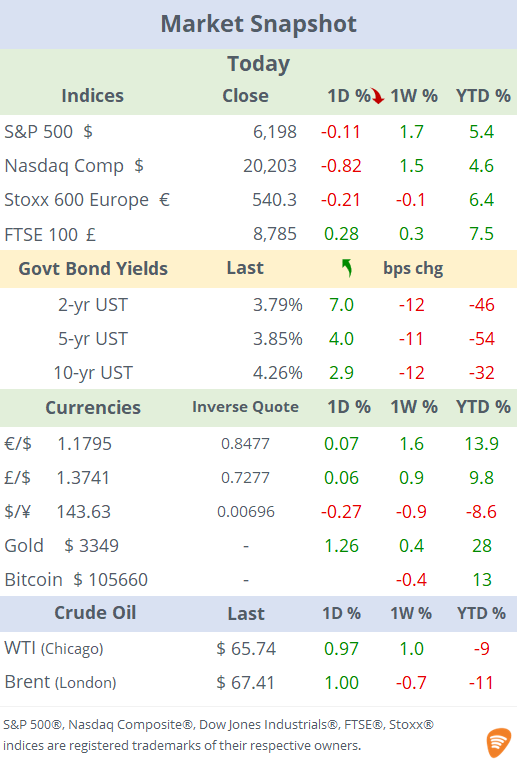

Markets were mixed today with Treasury bond yields partially reversing their recent downward trend as yields moved upwards, the Dow Jones Industrials and Russell 2000 gained 1% while the Nasdaq Composite fell nearly 1% with Materials as the outperforming sector. European bourses ended a touch weaker. Currency markets had a calm session, crude oil advanced 1% and the precious metals complex shifted higher.

Tesla shares fell 5% and are down 12% over the past week as tensions escalated between Elon Musk and President Trump, who questioned whether subsidies to Musk’s companies should be revoked—and even suggested he could be deported.

After an all-night session, the Senate narrowly passed Trump’s megabill (51-50 w/ vice-president Vance breaking the tie), featuring tax cuts and Medicaid spending reductions, advancing it to the House with the July 4 deadline still within reach. The Senate passed the measure by the slimmest of margins, echoing the razor-thin 215–214 vote in the House back in May.

Central banks: Trump criticized Jerome Powell again today on keeping interest rates too high for too long and the Fed Chair said he did not rule out a cut at the meeting at the end of July but the decision will be subject to data.

“Jerome — you are as usual ‘too late’,” “You have cost the USA a fortune — and continue to do so — you should lower the rate — by a lot!”, Trump posted.

The Bank of England is facing pressure to ease quantitative tightening with Gilts rallying after Governor Bailey signalled a possible reduction in the central bank’s bond sales. 10-year Gilts are yielding 4.44%, continuing a downward trend that began in late May.

Economics: inflation in the Eurozone accelerated marginally to 2% in June while core CPI rose by 2.3%, the same as in May. The ISM PMI in the US came in at 49.0 points, still in contraction, marking the 4th straight month below 50. The Services measure indicated a moderate expansion. China’s NBS manufacturing survey accumulated three months of contraction while the Caixin S&P indicator rebounded from May’s weak print and expanded during June (50.4). The final manufacturing PMI readings in Europe were stable to slightly weak during June.

Earnings: Constellation Brands (STZ, mcap $30bn, Corona and Modelo beers) reported after the close and missed sales ($2.52bn, -6% YoY) and profit ($516mn, -12% YoY) estimates, on lower beer demand and higher aluminium costs due to tariffs. Despite the quarterly miss, the co maintained its full-year adjusted EPS guidance. Shares traded flat in after hours following a 2.3% gain during the session.

Commodities: Cocoa futures plunged nearly 8% on projections for a larger crop for 2025/26 by the Ghana’s board, the world’s second largest producer.

Corporate deals: in the European banking sector, Santander (mcap €103bn), Spain’s largest bank, beat Barclays to acquire TSB from Sabadell for £2.65bn. Sabadell paid £1.7bn for TSB a decade ago and is now facing a hostile takeover from BBVA, Spain’s second-largest bank.

Torrent Pharma of India (mcap $13.5bn) has acquired a 47% stake in private equity-controlled JB Chemicals & Pharma for $1.4bn on one of the country's largest healthcare deals of the year, valuing JB at more than $3bn.

Euronext (mcap €15bn) confirmed it is in talks to acquire the Athens Stock Exchange for €400mn.

Reminder: US markets will be closed on Friday for Independence Day and will close early on Thursday. Canadian markets were shut today.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.