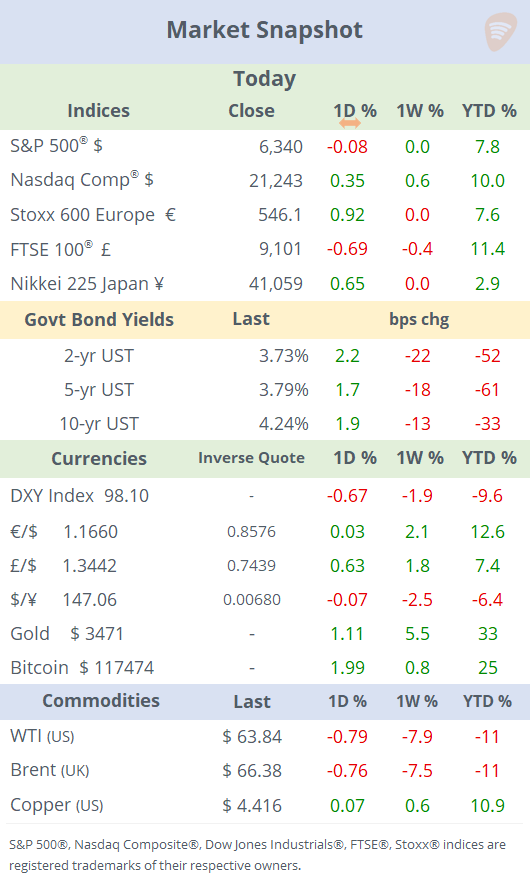

See the ‘Market Data’ post.

Good evening,

US equities finished mixed on Thursday as Trump’s tariffs on dozens of trade partners, ranging from 10% to 50%, took effect. The average import levy now stands at 18.6%, the highest since 1933. The Nasdaq Composite closed at a fresh record high after Trump suggested that Big Tech may be exempted from his proposed 100% duty on semiconductors. Healthcare was the worst-performing sector, weighed down by Eli Lilly’s sharp selloff after reporting.

Benchmark interest rates in dollars were little changed with short-end Treasury yields gaining marginally to 3.73% while the $ index fell again today and is already 2% lower in the past week, mainly agains the ¥ and €. Gold gained over 5% and crude oil plunged 8% WTD.

In geopolitics, Netanyahu said Israel will assume full control of the Gaza Strip, with plans to transfer authority to allied Arab forces once Hamas is defeated.

Central Banks: The Bank of England cut its key interest rate by 25bp to 4.0% in a closely split 5–4 decision, the narrowest margin since 1997. The vote revealed deep divisions within the MPC over how to balance weak economic growth against persistent inflation pressures.

BoE Governor Bailey noted that inflation is still expected to peak near 4% in September and stressed that any further easing would be “gradual and careful.” Market sentiment turned slightly more cautious: based on swap-implied pricing, traders now assign a 75% chance of another rate cut this year, down from over 90% before today’s announcement.

“We’ve cut interest rates today, but it was a finely balanced decision,” stated Bailey, adding that the path of rates “continues to be downward”.

In EM, Mexico’s central bank, Banxico, cut its benchmark rate by 25bp to 7.75% as widely expected, the lowest level in three years, following four consecutive 50bp cuts from an 11.25% peak. Headline inflation eased to 3.51%, the lowest in five years, while core CPI remained elevated at 4.23%, above the bank’s target.

Fed officials offered a measured tone on policy today: Bostic (Atlanta Fed) struck a mildly dovish stance, maintaining his outlook for just one rate cut in 2025, while Musalem (St. Louis Fed) leaned neutral to slightly hawkish, signalling comfort with holding rates steady and stressing the need to anchor inflation expectations before any easing.

Trump said he would nominate Stephen Miran, the head of the White House Council of Economic Advisers, to fill a vacancy on the Fed’s board of governors on a short-term basis.

Economics: It was a calm day for data. China’s July trade data surprised analysts, with exports jumping 7.2% YoY, well above forecast, as firms rushed to ship goods ahead of a looming US tariff deadline. Imports also rebounded 4.1% YoY, signalling tentative signs of domestic demand recovery. The trade surplus narrowed to $98bn, reinforcing optimism about easing trade tensions and supply chain shifts.

US weekly jobless claims rose by 7k to 226k in the week ending Aug 2, above expectations but still firmly within the healthy range. While the labour market remains stable, the increase in continuing claims to their highest level since 2021 hints at softening hiring amid heightened uncertainty. Sentiment reflects a "slow-to-hire, slow-to-fire" job market dynamic, indicating subdued momentum and cautious employer behaviour.

Earnings: Large caps that reported today include Eli Lilly, ConocoPhillips, Toyota, Allianz, Siemens and Deutsche Telekom before the open, while Gilead Sciences and The Trade Desk reported after the close. We’ll focus on those with significant stock action.

Giant pharma Eli Lilly (mcap $575bn) plunged 14% to its lowest level in 18 months (-15% YTD) after disappointing results from its experimental oral obesity drug, orforglipron. Despite strong Q2 financials and an upward revision of its 2025 revenue forecast, the underwhelming trial data overshadowed investor sentiment.

Cloud-based advertising platform The Trade Desk (mcap $43bn) marginally beat estimates but disappointed on guidance as it continues to restructure by announcing new management and shares plummeted 27% in extended trading to a three-month low.

Deals: A largely uneventful day for M&A action. Walt Disney’s ESPN has struck a landmark agreement with the National Football League to acquire NFL Network and other media assets, with the NFL receiving a 10% equity stake in ESPN, a stake estimated to be worth around $2.5bn.

IPOs: Firefly Aerospace (FLY), which builds rockets and spacecraft for satellite launch missions, priced its IPO at $45, above its guidance range, raised $868mn, debuted on the Nasdaq with a strong 56% jump to $70 before easing to close 36% higher on the day, and saw its market value soar from an initial $6.3bn to nearly $10bn.

WhiteFiber (WYFI), a cloud connectivity and fibre infrastructure provider based in Colorado, raised $160mn in its IPO, priced at $17, the top of the range. The market debut was poor with a 3% drop for a total market value of ~$580mn.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.