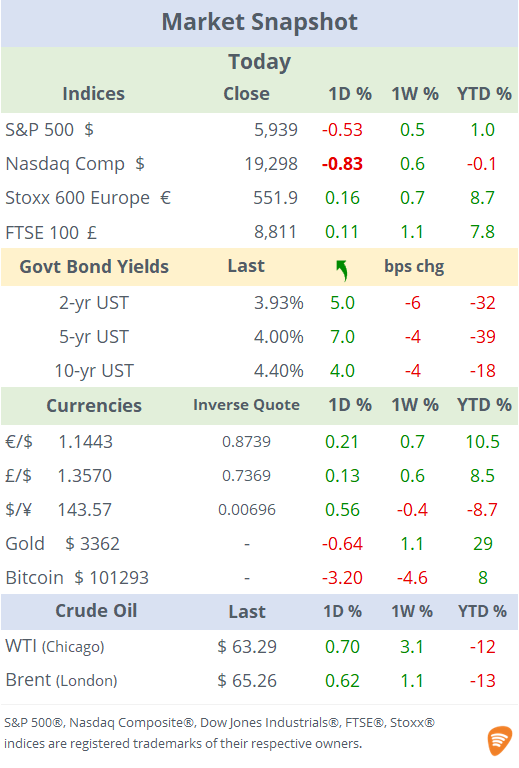

See the ‘Market Data’ post. Free subscribers: visit About.

Good evening,

It was a weak day for stocks with Nasdaq indices falling ~0.8% as Tesla plunges 14% on the back of a public row between Elon Musk and Trump. Tesla lost $152bn in market value today, had its worst daily drop in 4 years, a massive turnover of $80bn in a single day and accumulates a 30% decline YTD. The sharp downturn was driven by an escalating public dispute including insults via social media between Musk and the President over Trump’s budget bill and Trump even signalled he may terminate the contracts that Washington has with Musk’s companies, mainly Tesla (mcap $917bn) and SpaceX (private).

Tesla was, by far, the worst performing stock today among our top 200 companies by market cap, followed by Palantir Tech with an 8% fall. Almost every sector fell with consumer discretionary, which counts Tesla as a constituent, falling the most, -2.5% and became the worst sector this year with a 6.6% decline.

Monetary policy: the ECB cut its benchmark rates by 25bp as widely anticipated to 2% for the deposit rate and 2.15% for the refinancing rate and governor Lagarde said that rate cutting was “nearly concluded” after the central bank eased policy by 200bp in the past 12 months. The € appreciated marginally today but accumulates a 10.5% rally against the $ this year and 2% against £.

Earnings released after today’s market close, chip giant Broadcom (mcap $1.22tn) beat revenue ($15bn) and net income ($4.97bn) estimates and provided an upbeat outlook for the current quarter but shares declined marginally (-2.2%) in after hours and remain +10% YTD.

Corporate deals, consumer staples Kimberly-Clark Corp (mcap $45bn) plans to spin off Kleenex and other tissue products outside of the US via a $3bn JV with Brazilian giant pulp producer Suzano. Kimberly shares fell 2.2% and Suzano gained 7% today

In IPOs, Circle Internet Group, the parent of crypto stablecoin USDC (mcap $61bn) raised $1.1bn in its listing on the NYSE and saw shares skyrocket 168% from their $31 IPO price to over $83 for a market value of $17bn.

Tomorrow, we’ll get US non-farm payrolls for May with forecasts at +130k and unemployment to remain steady at 4.2%.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.