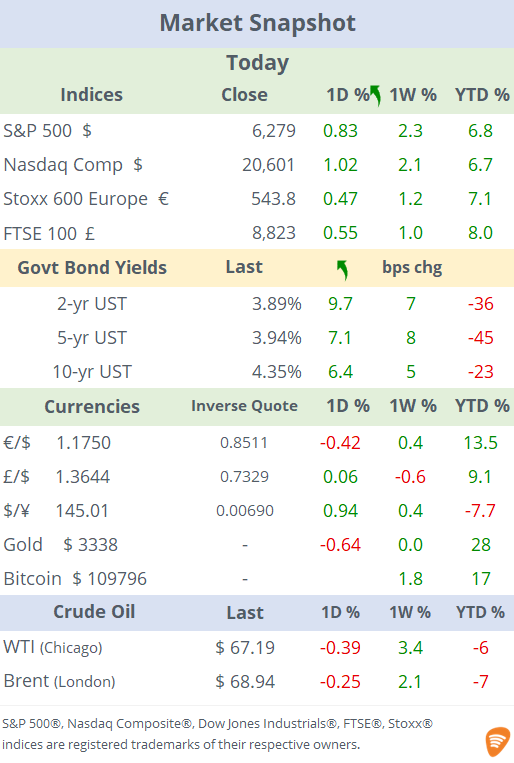

See the ‘Market Data’ post

Good evening,

Stocks surged to new record highs in today’s half trading session ahead of tomorrow’s holiday, with the S&P 500 up 0.8% and the Nasdaq also setting fresh records, driven mainly by a stronger-than-expected June nonfarm payrolls report. The jobs update showed gains of 147k, above expectations of +110k (see chart), and a surprise drop in the unemployment rate to 4.1% (as fewer people are looking for work), easing concerns about an imminent economic slowdown but reducing the urgency for a Fed rate cut. The employment growth was concentrated in government and healthcare, while manufacturing experienced declines amid trade uncertainty. Also, revisions showed that job creation was stronger in prior months than previously reported.

Further economic data: US average earnings decelerated marginally in June, expanding by 3.7% YoY vs 3.8% in May and came in below estimates. Weekly jobless claims were 233k, below estimates and the ISM Services PMI showed a small improvement to 50.8 points. The US economy continues to face uncertainty over trade. The manufacturing activity fell for the fourth straight month in June (ISM).

Bond yields shifted upwards by several basis points and the yield curve finished the week higher than a week ago, a clear reversal to the recent trend. One and two-year Treasuries sold off on Thursday with yields jumping 10bp.

In US politics, the House narrowly approved (218-214) the Republicans’ megabill, marking a significant win for Trump and once again highlighting his strong influence over Republican lawmakers.

The corporate sectors that benefit from the bill include fossil fuel companies, semiconductors, defense contractors, airlines, manufacturing, retailers and real estate developers. Those who are most impacted include electric vehicles, renewable energy, food producers, universities and hospitals.

Corporate deals: KKR-backed Athora Holdings, a savings and retirement services group, will acquire Pension Insurance Corp in the UK, for £5.7bn to expand its European operations. PIC manages a portfolio of £51bn, backing pensions of 400k people. The business will represent 45% of Athora’s total AUM.

PE firm Thoma Bravo will acquire Olo Inc (mcap $1.5bn), a restaurant-technology provider, in an all-cash deal valuing the co at around $2bn. Terms: $10.25/share, equal to a 65% premium to Olo’s undisturbed price. Olo gained 13% and is 32% higher YTD.

Happy holiday, see you on Monday.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.