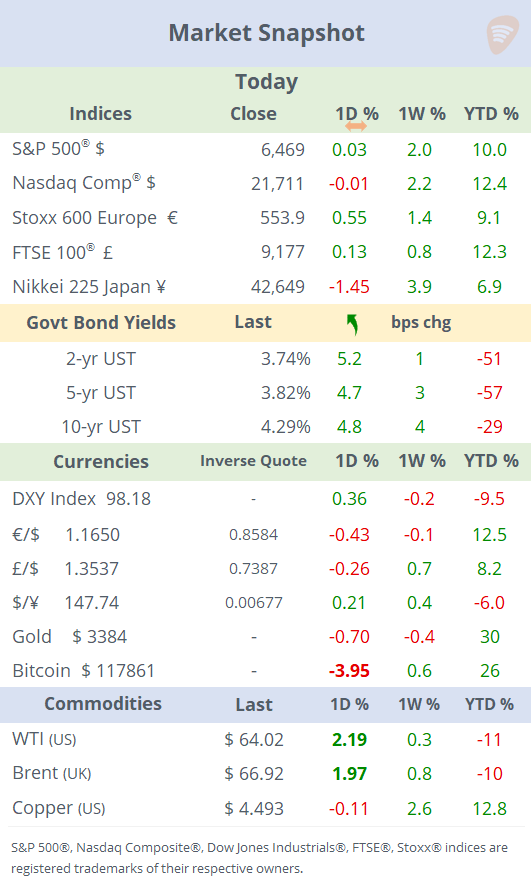

See the ‘Market Data’ post.

Good evening,

Stocks ended little changed on Thursday after a hotter-than-expected US wholesale inflation reading complicated the Fed’s rate-cut outlook. PPI inflation accelerated by 0.9% MoM, the largest monthly gain in over three years. The sharp jump raises concerns that higher business costs could pass over to consumers, keeping inflation pressures elevated and making the central bank’s decision on a September cut more difficult.

Bond yields reversed their recent downward trend and shifted higher, with the Treasury yield curve moving up by 5bp across maturities. Bitcoin and Ethereum fell 4% as the chances for lower rates fell slightly today.

Crude oil partially bounced back, gaining 2% on speculation around tougher sanctions if the Trump-Putin summit on Friday falters, even as markets brace for weaker fundamentals.

ℹ️ Free subscribers and visitors have access to unlocked posts.

Keep reading with a 7-day free trial

Subscribe to U.S. Markets Daily to keep reading this post and get 7 days of free access to the full post archives.