Free subscribers: visit About.

See the ‘Market Data’ post.

Good evening,

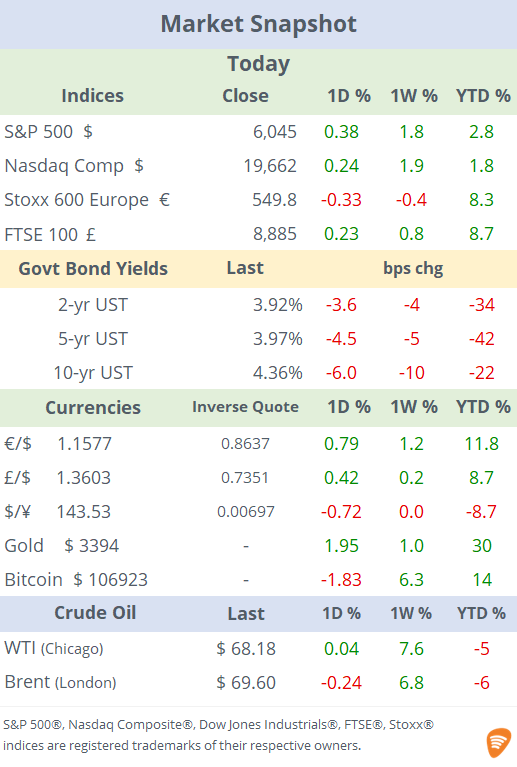

Thursday was a positive day for risk assets with leading US stock indices shifting higher and the S&P 500 reaching its highest level in four months and closing shy of its all-time high at 6,045 pts. Bonds rallied again today with benchmark Treasury yields dropping up to 7bp for longer maturities and 5-yr bonds now yielding below 4%. The $ continues to depreciate and the DXY index is trading at a 3-yr low below the 98-point level.

In single names, Boeing (mcap $154bn) saw shares plunge 5% following the Air India Dreamliner 787 crash this morning (NYT). GE Aerospace, this aircraft’s turbine manufacturer, dropped 2%. Oracle rallied 13% today to a record high following yesterday's strong earnings report and rosy outlook announcement (CNBC).

Today’s key economic release was a muted US producer price inflation (PPI) in May which grew by 2.6% YoY, in line with estimates but marginally above the previous month. The Fed meets next Wednesday, and markets are discounting (97%) the FOMC will keep interest rates steady at a 4.25-4.50% range.

In other data, the UK economy contracted in April, down 0.3% MoM, worse than expected, and +0.9% YoY, the slowest in twelve months as businesses cut jobs and cancel investments in response to global trade uncertainty. Industrial production also eased 0.6% MoM, its fourth negative month this year (Guardian). Yet, British stocks outperformed European benchmarks today and closed at an all-time high, accumulating a 9% gain YTD. Lastly, India’s consumer inflation fell to the lowest in six years, +2.82% YoY.

In earnings releases after the close, software giant Adobe (mcap $176bn) beat expectations, reported record sales ($5.87bn) in a robust financial update but shares declined slightly in extended trading. (Barron’s)

In deals, biotech company BioNTech (mcap $25bn) is set to acquire smaller rival CureVac (mcap $1.2bn) in an all-stock deal valued at $1.25bn. CureVac will control ~5% of the combined company as BioNTech aims to integrate its capabilities for transformative cancer treatments. CureVac shares rallied 36% today and are up 63% YTD.

In IPOs, fintech Chime Financial (CHYM) raised over $800mn, was priced at 27, shares rallied 37% to a market cap of $16bn, well below its last private valuation round of $25bn, four years ago. Chime made $13mn of profits on $519mn of revenues in its most recent quarter.

Friday’s data: Michigan consumer sentiment in the US, industrial production in the EU, final inflation in Germany and France.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.