See the ‘Market Data’ post.

Good evening,

Risk assets fell on Monday as trade conflicts escalated. Trump announced 25% levies on Japan, South Korea and sent letters to other countries with tariff updates, intensifying tensions while extending a deadline on so-called reciprocal tariffs to August 1. Major US indices sold off around 1% while European benchmarks, which had already closed, ended firmer. The $ appreciated and long-end Treasury yields shifted upwards. Trump's megabill was signed into law on Friday.

Tesla was the notable mega cap mover with a 6% decline after Elon Musk said he would create a new political party called “America Party”, escalating his confrontation with Trump.

“He can have fun with it, but I think it’s ridiculous,” Trump said.

In commodities, eight oil-producing nations of the OPEC+ alliance agreed on Saturday to lift their combined production by 548k bpd, more than analysts’ estimates of 411k, as they continue to unwind a series of voluntary supply cuts. OPEC justified their decision on “a steady global economic outlook and current healthy market fundamentals, as reflected in the low oil inventories.” Brent oil advanced 1.2% today to almost $70.

The week began with a light economic calendar, highlighted by Europe’s retail sales as the main release. Eurozone retail sales fell 0.7% MoM in May and expanded by 1.8% YoY, mostly in line with expectations. Declines were seen in food, drinks and tobacco sales while non-food product and automotive saw higher sales. Countries that recorded the largest monthly retail sales declines were Sweden, down by 4.6%, then Belgium with a 2.5% drop and Estonia with a 2.2% fall. On the other hand, retail sales in Portugal and Bulgaria rose by 2.1% and 2%. On average, retail sales in the continent have grown by ~2% YoY for the past ten months.

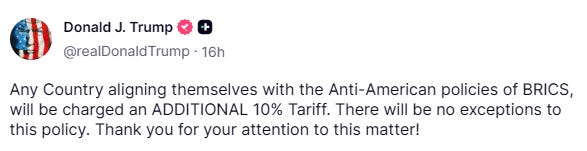

The BRICS Summit is taking place in Brazil. Leaders issued a joint statement condemning military action in Iran and Gaza. The bloc reaffirmed its push to increase trade in local currencies and reduce dependence on the dollar in global trade and finance. In response, Trump warned that any member aligning with 'anti-American' policies could face an additional 10% US tariff.

It was an active day for corporate deal announcements. CoreWeave (CRWV, mcap $76bn), the AI data centre group, will acquire rival Core Scientific (CORZ, mcap $4.4bn) in an all-stock deal worth $9bn, when digital assets and off-balance sheet items are included. Terms: 0.1235 CoreW shares per CoreS. Core Scientific shareholders will own <10% of the combined co, and shares plunged 18% today despite the bid representing a 66% premium. (FT)

In the precious metals sector, Royal Gold (RGLC, mcap $11bn) announced two acquisitions worth $3.7bn to become one of the largest gold streaming companies in the world behind Wheaton Precious and Franco Nevada Corp. RG will acquire Canada’s Sandstorm Gold (SAND, mcap $3bn) for $3.5bn in stock and Horizon Copper for ~$200mn. Sandstorm shares on the NYSE gained 6% today and 85% YTD. (WSJ)

Also, French IT consulting co Capgemini SE (mcap €23bn) agreed to buy India’s multinational business process management Co WNS Holdings (mcap $3.25bn) for $3.3bn in cash. Terms: $76.5 per WNS share, which represents a premium of 17% to its undisturbed price. WNS shares jumped 14% today and 57% YTD. (CapG)

This week: light on data releases with the Fed Minutes on Wednesday and UK’s GDP on Friday. The Q2 earnings season in the US is set to kick off next week, with the first wave of reports scheduled for Thursday with Delta Air Lines and Conagra.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.