See the ‘Market Data’ post

Good evening,

Trade deal optimism and geopolitical calm in the Middle East fueled the risk-on sentiment that extended the rally. US stocks rose again at the start of the week to conclude a historical reversal in Q2 from a steep sell-off following Trump’s Liberation Day to fresh record highs. The S&P 500 and Nasdaq indices rallied more than 25% since early April and are now 5% higher in H1’25. In brief, the market went from the depths of the tariff war to record highs less than three months.

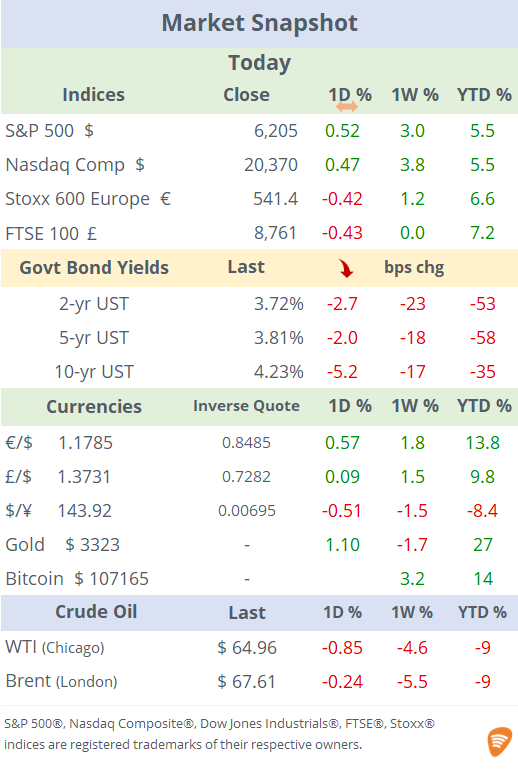

Benchmark bond yields fell sharply in this chaotic first half of the year with 2 and 10-yr Treasury yields declining by ~55bp to 3.72% and 4.23% respectively. The $ (DXY index) depreciated 11% to a 3.5-yr low with the € and Swiss Franc as the main gainers YTD. Precious metals rallied 25% on average so far this year with gold ending the quarter at $3,324, only 5% away from its all-time high.

After Friday’s breakdown in trade negotiations when Trump condemned the tax as a “blatant attack” and threatened higher tariffs on Canadian imports, Canada agreed to withdraw its levy on major US tech firms just hours before the first payments were due, paving the way for talks to restart.

Economics: The Chicago PMI (assesses the business conditions and the economic health of the manufacturing sector in the Chicago region), declined for a third straight month to its lowest level since January to 40.4 points, well below the expansion threshold (50).

The preliminary inflation data for Germany shows that it unexpectedly cooled to 2% YoY in June (lower than estimates), matching the ECB’s target. French and Spanish HICP inflation readings reflected a small increase while Italian prices came in line with estimates at 1.7% YoY.

The UK economy expanded 0.7% QoQ in Q1’25, the fastest pace in one year on robust services and industrial production. This followed a mere 0.1% QoQ growth for Q4’24. On an annual basis, the GDP expanded 1.3%.

Corporate deals: Home Depot (mcap $364bn) agreed to acquire building products distributor GMS Inc (mcap $4.1bn) for an EV of $5.5bn and will become part of the HD’s SRS Distribution subsidiary. GMS shares jumped 11% today and accumulated a 28% gain YTD.

Also, drugmaker giant AbbVie (mcap $328bn), said it would buy privately held cell therapy developer Capstan Therapeutics for up to $2.1bn, expanding its product pipeline with experimental drugs for autoimmune diseases.

IPOs: Seaport Entertainment Group, a diversified entertainment, hospitality, and real estate company, was uplisted from the American to the NYSE, raised $175mn at $25/sh (above the mkt price), for a market cap of $237mn at the close on Monday.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.