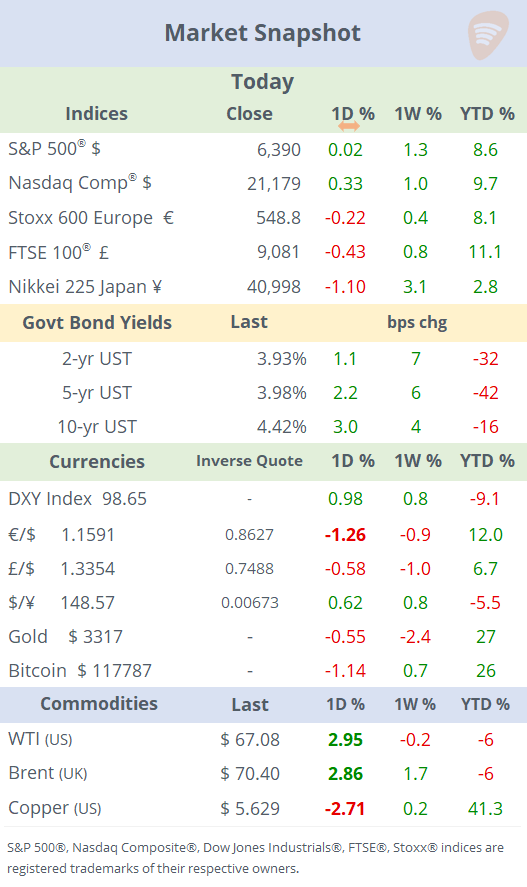

See the ‘Market Data’ post.

Good evening,

Sunday’s trade agreement between Washington and Brussels, which removed the risk of a prolonged trade war, set the tone for today’s trading. US stocks ended marginally higher at fresh record highs, while European benchmarks declined as investors viewed the terms as tilted against the EU. The terms set a 15% baseline tariff for European goods, including autos, and the EU will buy $750bn in energy products from the US and invest $600bn. However, semiconductor equipment will be subject to "zero-for-zero" tariffs, which helped chip stocks rally.

This deal is the most significant agreement Trump has announced to date, as both sides exchange $5bn worth of goods and services every day. The White House continues to negotiate with China, Mexico and Canada ahead of Friday’s deadline set by Trump. The deals with the EU and with Japan last week helped crude oil prices rally 3% on Monday, with Brent trading above $70.

Today’s action was centred on currency markets with the $ appreciating across the board but mostly against the € and the Swiss Franc. The € remains 12% stronger YTD against the $. Treasuries were little changed with long-end yields adding 3-4bp ahead of this week’s Fed meeting. The yield curve has shifted upwards in the past week and month.

Earnings: Dutch brewer Heineken’s (mcap €40bn) shares dropped over 8% today to a four-month low, despite a profit increase (+7.4%) that beat forecasts in H1 and maintained full-year guidance, as investor concerns grew over softer H2 profits and volumes, with the company warning that tariffs could weigh on confidence. Shares are down 22% in the LTM.

Earnings expected tomorrow: Visa, P&G, UnitedHealth, AstraZeneca, Boeing, L’Oreal, Starbucks, PayPal, among other large caps.

Monday was a quiet day on the corporate deals front. Danish biotech co Bavarian Nordic A/S (mcap €2.5bn), a ‘pioneering force in vaccines’, agreed to be taken private by PE firms Permira and Nordic Capital for $3bn. Terms: DKK 233/share, a 21% premium to BAVA’s undisturbed price. BAVA gained 2% today and closed above the bid and accumulated a 26% rally YTD.

In IPOs, two notable filings were submitted in the US: Figma, the San Francisco-based design software firm, aims to raise $1.18bn at a $19bn valuation after raising its target price to a 30-32 per share range. It is expected to be priced on late Wednesday for a trading debut in the NYSE on Thursday under the FIG symbol. The company, founded in 2012, is backed by several VC firms, including AH, Index Ventures, Greylock and Sequoia.

Also, Texas-based Firefly Aerospace (FLY) announced its plans to raise up to $632mn at a $5.5bn valuation on Nasdaq with a price guidance of $35-39. Expected to be priced in early August.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.