See also the ‘Market Data’ post.

FYI- Only subscribers can access the latest podcast and the full script below. Non-subscribers can access unlocked episodes.

Good evening,

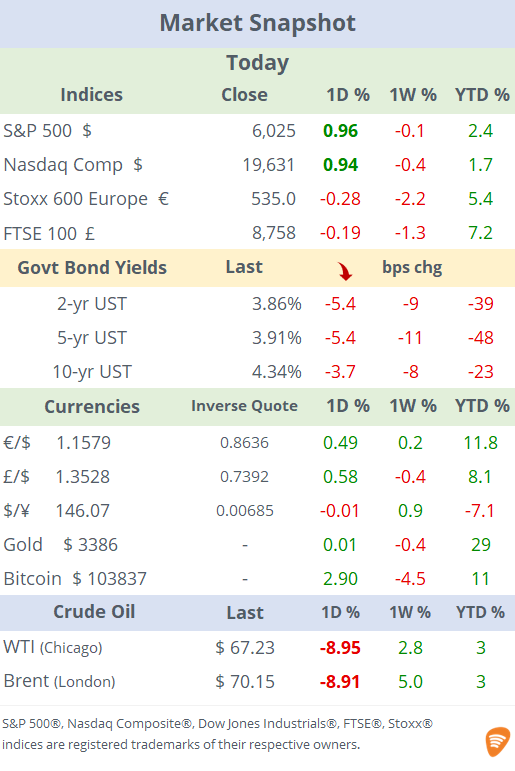

The week began with a risk on trading day despite the US attack on Iran’s nuclear sites on Saturday as Tehran’s retaliation, striking US bases in Qatar and Iraq, failed to impress markets. Also, Moscow showed a lukewarm support for Iran.

Major US stock indices gained 1% on Monday, crude oil plunged from Friday’s close after rallying over 6% on Sunday evening following the involvement of the US and Iran’s threat to close the Strait of Hormuz, the world's busiest oil shipping channel. Traders expect Iran to avoid disrupting oil transport routes as it would greatly affect its finances. The last 24 hours were the most volatile for oil markets in years with Brent back to $70.

The $ depreciated slightly and benchmark bond yields continued to fall with the US Treasury yield curve shifting lower by ~5bp, maintaining the downward trend.

The relevant data released today were the preliminary PMIs with the US manufacturing (52 pts) and Services (53.1) readings coming better than expected and both in expansionary territory. In the Eurozone, PMIs were marginally worse than expected but Germany showed signs of improvement while the UK was mostly in line with estimates with the Services sector much stronger than Manufacturing. Also, existing home sales in the US, surprised analysts with a rise of 0.8% MoM against expectations for a contraction.

In single stocks, the notable mover among our large-cap universe was Tesla with an 8% rally today following this weekend’s successful launch of its robotaxi in Austin pushing Tesla closer to autonomy marking a key milestone for the company.

In the mid-cap sector, personal products co Hims & Hers Health (mcap $9bn) plunged 35% after pharma giant Novo Nordisk (-5.5%) terminated its partnership, citing concerns about its marketing practices. Still, H&H shares are 74% higher this year.

In corporate deals, Bank of New York Mellon (mcap $64bn, world’s largest custodian) approached Chicago-based Northern Trust Corp (mcap $23bn) last week for a potential merger and may table a formal bid. Northern did not express interest at first. Its shares gained 8% today and are 18% higher YTD.

In the food sector, C&S Wholesale Grocers, privately controlled by the Cohen family, will acquire SpartanNash (mcap $900mn) in a deal valued at around $1.8bn, including debt. SpartanNash shares jumped 50% today to a 2.5-yr high. The deal is expected to close by year end.

In the UK, private equity firm Advent International has agreed to acquire industrial company Spectris Plc (mcap £4.38bn) in a £4.4bn deal. Shares jumped 13% today and accumulated a 52% gain YTD.

Also in the UK, Athora Holding, the European savings and retirement services platform backed by Apollo, is in advanced negotiations to acquire Pension Insurance Corporation in a transaction that could value the UK-based insurer at £5bn.

Week ahead: on Tuesday, Canada reports inflation and Fed chair Powell testifies before Congress. The central bank of Mexico holds a policy meeting on Thursday (-50bp to 8% exp). Thursday and Friday will be busy for US economic data with GDP, durable goods and PCE inflation updates.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.