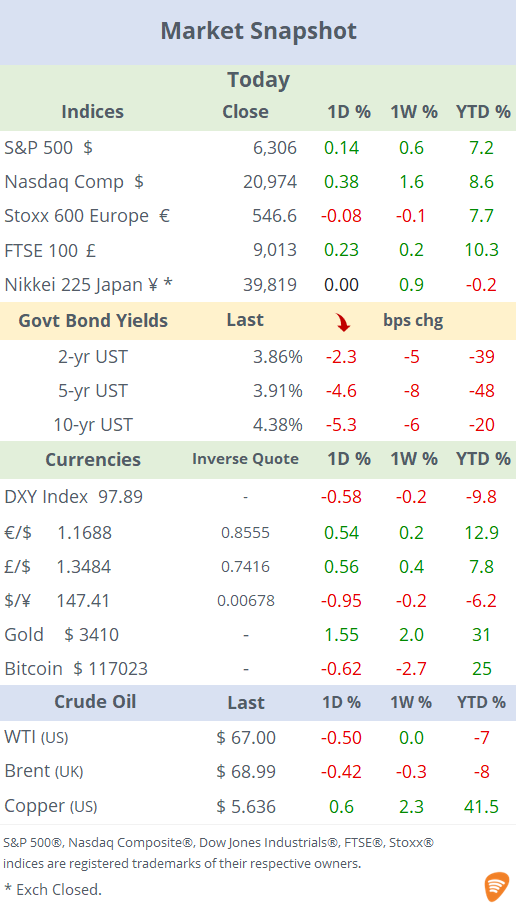

See the ‘Market Data’ post.

Good evening,

US stocks traded mixed at the start of the week, with Nasdaq benchmarks reaching new records while the S&P 400 Mid Cap and Russell’s 2000 small-cap indices finished lower. Overall, equities maintained their recent bullish trend, driven by rising earnings expectations following largely positive reports last week. The $ fell sharply today, mainly on the back of a stronger ¥ despite Japan’s holiday. Benchmark bonds continue to move higher with long-end yields dropping another 5bp and the 10-yr yield closing at 4.38%.

In currency markets, the notable mover and the main driver for a weaker dollar index was the yen’s rally following the surprise result of yesterday’s parliamentary election in Japan which triggered the unwinding of carry trades. Local markets were closed on holiday, so the action was mostly offshore. The Prime Minister’s ruling coalition lost the majority of the upper chamber as the nationalist and democratic parties, which support tax cuts and fiscal expansion, gained space. (AP)

Earnings: Verizon Comm (mcap $180bn) beat quarterly revenue ($34.5bn, +5.2% YoY) and earnings ($5.1bn, +9% YoY) estimates and raised its earnings, free cash flow and cash flow from operations forecast for the year. Shares gained 4% today and are 6% higher YTD. As of Friday, 83% of S&P 500 members that had reported earnings beat expectations. This week, more than 100 index constituents are set to report, with the Magnificent Seven kicking off on Wednesday. Large caps reporting tomorrow include: Coca-Cola, Philip Morris, Raytheon Tech, Texas Instruments, GM and Germany’s SAP.

Central Bank action: China’s PBoC maintained its loan prime rates (LPRs) for 1-yr at 3% and 5-yr at 3.5% as expected, their lowest level since 2019. Investors welcomed the hold as a sign of economic resilience, but there was no significant market move. In developed markets, ECB officials (de Guindos, Kazaks) emphasised caution over the strength of the €, justifying a pause in rate cuts ahead of Thursday’s policy meeting. Tuesday will be an active day for speeches with Fed Governors Jay Powell and Bowman, as well as ECB’s Lagarde, participating in conferences.

Corporate deals: In private markets, KKR acquired a significant minority stake in Etraveli Group, the Swedish travel tech platform backed by CVC Capital, valuing it at ~€2.7bn.

Flexjet, the second-largest private jet co after NetJets, raised $800mn from PE firm L Catterton (linked to the LVMH family) at a $4bn valuation. (AvWeb)

Norway’s privately held online media group Adevinta divested its Spanish business (including platforms such as Coches.net, InfoJobs, Milanuncios, Fotocasa, and Habitaclia) to Swedish PE firm EQT for an EV of ~€2bn. (Reuters)

Crypto sector: Trump Media & Technology Group (mcap $5.5bn) announced it has acquired ~$2bn worth of Bitcoin to hold as part of its corporate treasury assets. DJT shares rose 5% today but remain 42% lower this year. (CBS)

SPAC Dynamix is merging with The Ether Reserve to create a new co called The Ether Machine and plans to manage >$1.5bn in ETH.

Lastly, BitGo, the crypto custody co, last valued at €1.75bn in a Series C funding round in August 2023, filed its IPO plan with the SEC today. (BWire)

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.