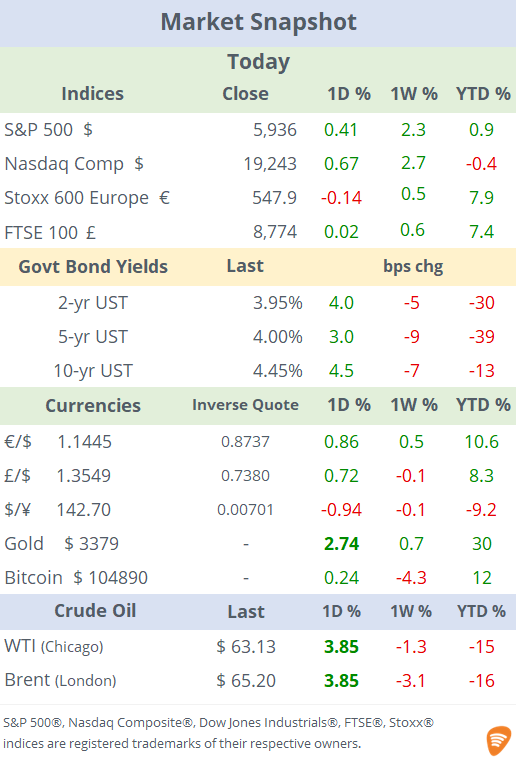

See the ‘Market Data’ post. Free subscribers: visit About.

US stocks had a positive start of the week with Nasdaq indices outperforming its peers and advancing 0.7%. The energy sector was the best performer on the back of a strong day for crude oil and natural gas prices.

However, today’s focus was on the $ weakness as the DXY index plunged below 99 points to a 6-week low and accumulated a 9% drop this year. The greenback depreciated against all majors on Monday, driven by recession fears following a weak manufacturing PMI print, and tariff tensions despite news regarding China. The U.S. Trade Representative announced a 3-month extension on some Chinese goods until the end of August, leaving more time for parties to reach an agreement. Yields on long-end Treasuries rose 4bp to 4.97% and the precious metals complex rallied on demand for safe assets with silver jumping nearly 6%.

In economics today, mixed to poor PMI readings in the US, as the S&P showed an expansion (52) while the ISM measure remains in contraction (48.5). Meanwhile in Europe, the latest manufacturing PMIs for Germany, France, Italy and the UK confirmed that activity levels are in contraction (<50 pts) across the region, with France marginally better and the UK as the weakest country.

In commodities, leading OPEC members decided on Saturday to increase July’s production output by 411k barrels per day, or 0.4% of global output, less than analysts had expected. This increase adds to a total rise of 1.37mn bpd since April. Crude prices rallied 3.8% today after Ukraine launched a massive drone attack on dozens of Russian military planes in Russian territory, an attack that took more than a year to plan. US policymakers said they aim to further restrict Moscow’s oil from reaching international markets.

In corporate deals, french leading pharma Sanofi (mcap $125bn) is acquiring Blueprint Medicines Corp (BPMC, mcap $8.2bn) of the US, for up to $9.5bn, to expand in the development of drugs for rare blood disorders. Blueprint shares jumped 26% to a record high and accumulated a 46% rally YTD. (FT)

In private markets, xAI, Elon Musk’s artificial intelligence company, which recently absorbed the X messaging app in a $33bn deal, is launching a $300mn share sale that values the parent co at $113bn. xAI is also seeking to raise $5bn in a series of debt instruments (loans and HY bonds) in a deal led by Morgan Stanley. (Reuters)

In secondary equity listings, Valterra, the platinum division that spun off from Anglo American, began trading in London today, in addition to its main listing in South Africa. (Shares gained 2%).

There were no significant earnings reports today.

It will be an active week regarding economic releases and monetary policy meetings with an inflation update for the EU tomorrow, non-farm payrolls in the US on Friday and the Bank of Canada meeting on Wednesday (no chg exp) and the ECB on Thursday (25bp cut to 2.15% exp).

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.