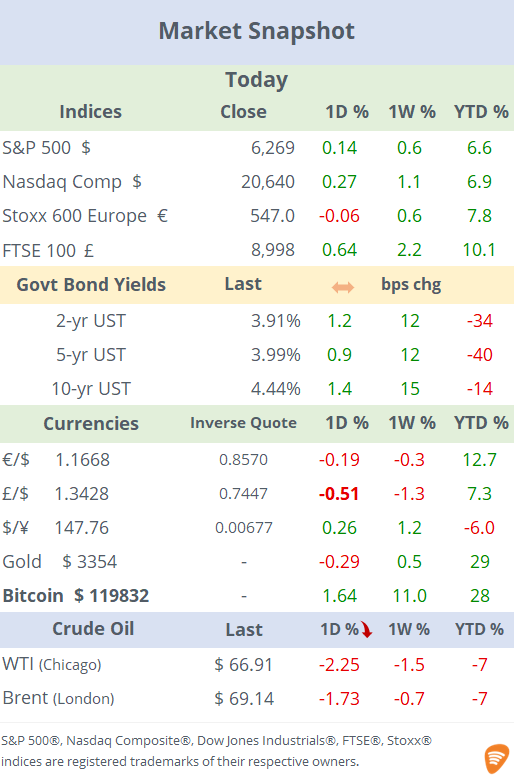

See the ‘Market Data’ post.

Good evening,

Risk markets finished modestly firmer on Monday with Nasdaq stocks advancing to a record high during a trading session that included a mix of tariff updates, with war-related headlines, all ahead of a busy week for earnings and economic data releases.

Trump announced new 30% tariffs on imports from the EU and Mexico, effective August 1, raising trade tensions and at the same time threatened to increase economic pressure on Moscow if a Ukraine peace deal isn’t reached within 50 days. He criticised Putin’s behaviour and decided that Kyiv will receive new weapons and air defences within days under a new agreement with NATO, a significant policy shift. Washington will impose “very severe tariffs (of 100%) if we don’t have a deal in 50 days,” Trump said.

Most US stock sectors gained marginally today, with energy as the biggest mover, down 1.1% on the back of weaker crude oil prices (-2%), following a report on soaring Saudi Arabia oil exports in July. Benchmark bond yields were little changed ahead of tomorrow’s inflation update. Bitcoin traded near $120k, reaching another new all-time high.

Economic data: China’s exports rose 5.8% YoY in June, up from 4.8% in May, higher than forecasts and signalling resilient demand despite trade tensions. Imports turned positive, increasing 1.1% YoY, the first rise of the year, showing improving, but still weak, domestic demand. The trade surplus surged to approx $115bn in June, up 11% from May, a record level driven by stronger export momentum and softer imports.

In other emerging markets, India’s headline inflation decelerated to 2.1% YoY, below expectations and the lowest since early 2019. Argentina’s retail inflation also eased to 39.4% YoY (1.6% MoM), the lowest reading since early 2021.

Earnings: Fastenal, the $52bn industrial and construction distributor, kicked off the Q2 earnings season today with results that narrowly beat sales ($2.08bn, +8% YoY) and profit ($330mn, +13% YoY) estimates, sending shares up by 5% to an all-time high and a 26% gain this year. Big banks (JPM, Citi and Wells Fargo) report tomorrow before the open.

Corporate deals: In the US healthcare sector, medical instrument supplier, Becton, Dickinson and Co (mcap $51bn), will spin off its Biosciences & Diagnostics Solutions division and merge it with Waters Corp (mcap $18bn) in a $17.5bn deal. The merger aims to create a leading entity in the life sciences and diagnostics sector, focusing on regulated, high-volume testing. Waters’ shares plunged 14% to a one-year low.

In the regional banking space, Huntington Bancshares (mcap $25bn) announced it will acquire Veritex Holdings (mcap $1.8bn) in a $1.9bn all-stock deal, to expand Huntington's presence in Texas, adding over 30 branches and $13bn in assets. Veritex shares rallied 20% to the highest level since last September.

IPOs: Almonty Industries Inc (ALM, tungsten mining) raised $90mn in its Nasdaq listing at $4.50 a share for a market cap of ~$340mn. The stock closed at $4.77 on its debut.

Data tomorrow: retail inflation (CPI) in the US and Canada; GDP, retail sales and industrial production in China.

See you tomorrow.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.