See the ‘Market Data’ post.

Good evening,

With the conflict in the Middle East appearing to subside, investor attention has shifted back to tariffs as the primary concern. The latest on this front was Trump´s halt of trade negotiations with Canada over a big-tech tax dispute. He said he will set a new tariff on imports from the country within a week (“Canada, a very difficult country to TRADE with”). Meanwhile, Commerce Secretary Lutnick and Treasury Secretary Bessent both stated that the US is nearing several other trade agreements.

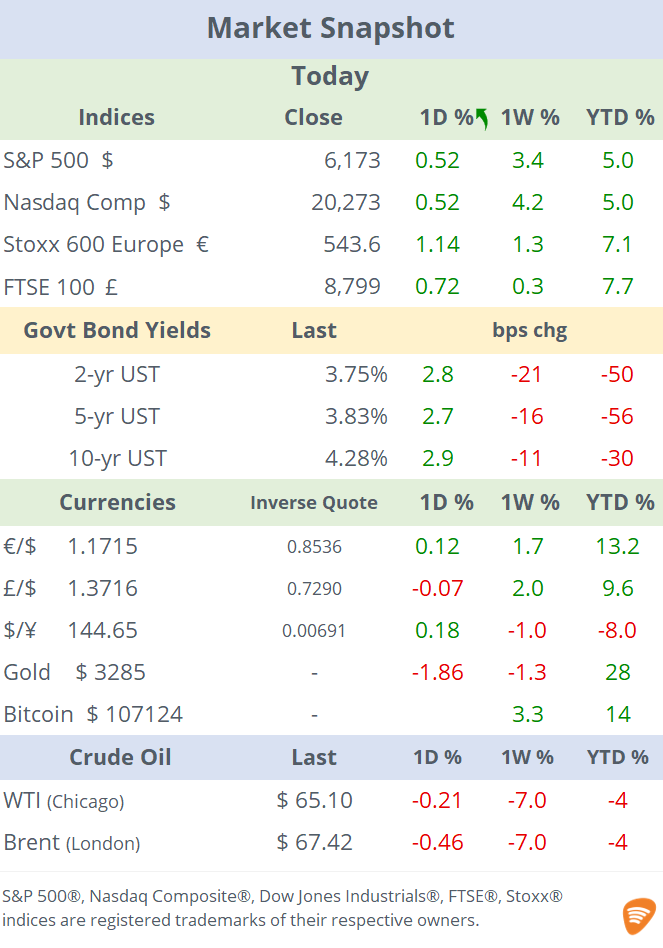

Markets posted another strong day with leading indices advancing 0.5% to a fresh record high and Europe rallying over 1.5%. Nasdaq indicators gained 4.2% WTD while Germany´s Dax added 3%. The S&P 500 has rebounded 28% from its lows following the Liberation Day sell-off.

Gold is trading below $3,300, down >1% on the day, as safe-haven flows continue to unwind. The $ index remains steady near its 3.5-yr low with mild moves for currencies on Friday. Sterling, the Swiss Franc and the Euro appreciated around 2% this past week, with the outlook for the US deficit and growing debt as the main catalysts.

Today´s key data release was PCE inflation (personal consumption expenditures) for May, with the headline reading rising by 2.3% YoY, in line with estimates but a small uptick from the previous month, and the first increase in four months. The core PCE reading, the Fed´s preferred gauge of inflation, came in at 2.7%, higher than forecasts and accelerating from the 2.5% in April.

Keep reading with a 7-day free trial

Subscribe to U.S. Markets Daily to keep reading this post and get 7 days of free access to the full post archives.