Fri 23 May: After the Bell

See the ‘Market Data’ post.

Good evening,

The tariffs war took an unexpected turn and escalated after Trump announced a 50% levy on goods imported from the EU from June 1st, as negotiations were not progressing. US stocks sold off sharply but managed to partially recover during the session while European indexes ended sharply lower.

“Our discussions with them are going nowhere! Therefore, I am recommending a straight 50% Tariff on the European Union, starting on June 1, 2025”, Trump posted on his Truth social media.

Washington imposed a 20% “reciprocal” levy on most EU goods on Liberation Day but halved that rate a week later until early July, to allow time for talks.

Also, Trump threatened with a 25% tariff on iPhones made outside of the US as he builds pressure on Apple to produce domestically. Apple had recently announced that iPhones sold in the US would move manufacturing from China to India. Apple shares fell 3% today and are already 22% lower this year. (Chart on Market Data post)

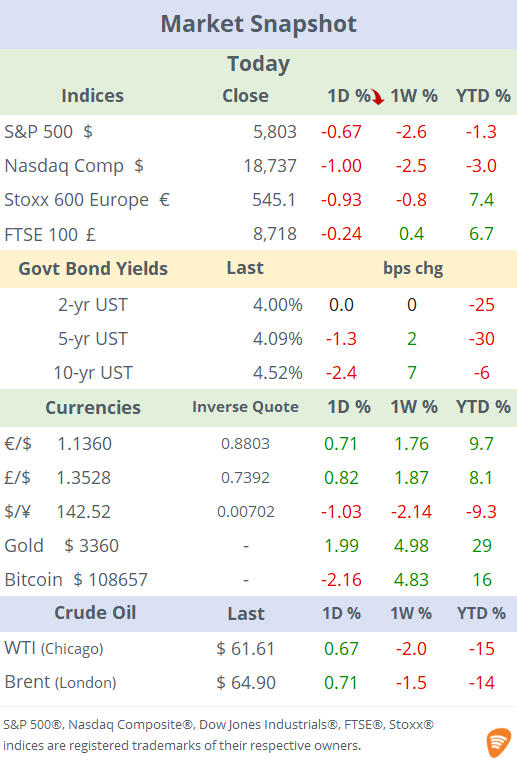

All US equity sectors finished the week significantly lower with energy (-4%) and IT (-3.4%) as the biggest losers while the S&P 500 lost 2.6% and the Russell 2000 fell 3.5% WTD.

Bond markets were little changed on Friday and Treasury yields finished a volatile week a few basis points higher. The $ fell against all major currencies and accumulated a 2% depreciation this week while Gold jumped 2% today and is up 5% WTD.

Economic data releases today were mostly positive with strong US new home sales (+743k), above estimates and the highest in 12 months.

Retail sales updates in Canada (+5.6% YoY) and the UK (+5%) were the strongest prints in more than a year and maintain a positive trend.

Germany’s final GDP came in at 0% YoY, poor but better than forecasts as the economy accumulates two years of stagnation.

Inflation in Japan rose by 3.6% YoY, close to a 3-yr high with core CPI also accelerating 3.5%. The spike in inflation, recent weak bond auctions and general fiscal concerns, led to a bond sell-off that sent JGBs long-term yields to over 3%, and all-time high. The BoJ meets in mid-June.

In potential corporate deals, press suggest privately-owned adult platform OnlyFans is in talks with a US investment co (Forest Road Co) for an $8bn acquisition. UK-based O.F. (owned by Leonid Radvinsky) posted revenues of $1.3bn and pre-tax profits of $660mn in 2023. (FT)

In media, US private equity firm RedBird Capital Partners will acquire Britain’s Daily Telegraph newspaper in a deal valued at $670mn including debt. (Guardian)

In credit markets, privately-owned CoreWeave (mcap $48bn, B+/Ba3 rated), an AI data centres company raised $2bn in 5-yr unsecured high yield bond at a 9.25% yield. The deal attracted $7bn in orders. (CNBC)

Fed chief Powell is scheduled to speek at an event on Sunday evening ahead of the Fed’s policy meeting in mid-June.

It’s the Memorial holiday in the US and a bank holiday in the UK on Monday 26th.

That’s all for this week, thanks for your time, enjoy the long weekend.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.

S&P 500®, Nasdaq 100®, Dow Jones Industrials®, FTSE®, Stoxx® and other indices are registered trademarks of their respective owners.