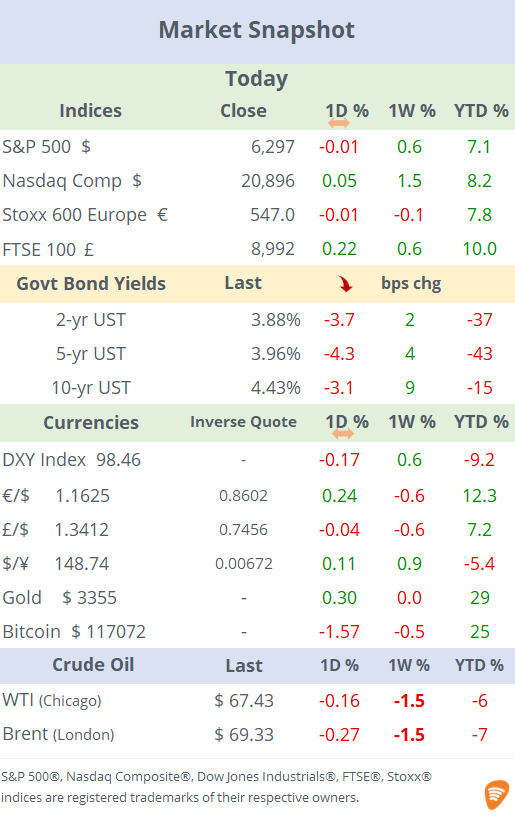

See the ‘Market Data’ post.

Good evening,

US stocks finished little changed on Friday, with the small-cap sector underperforming, but leading indices ended firmer on the week with the Nasdaq Composite reaching a new record after advancing 1.5% WTD. The energy and healthcare sectors were the notable losers this week while IT and utilities outperformed. Treasury bond yields moved lower on Friday, driven by dovish remarks by Chris Waller and finished the week almost unchanged.

Trump is reportedly advocating for increased blanket tariffs on imports from the European Union, complicating negotiations before the August 1 deadline for broad duties to come into effect. Media reports suggest that Trump seeks a minimum tariff rate of 15% to 20% on EU goods as part of any agreement.

Fed speeches: Governor Christopher Waller called for a 25bp rate cut at the July 30 meeting, citing signs of a weakening labour market and limited inflation risks from tariffs and signalled he supports further rate cuts later in the year if necessary. He also said he would consider stepping into the Fed Chair role if asked by Trump.

Data: the preliminary Michigan Consumer Sentiment indicator for July rose slightly (to 61.8 pts) and had its best month since February. US housing starts increased 4.6% in June to 1.32mn while building permits were little changed at 1.4mn, still near its three-year low. Elsewhere, headline inflation in Japan in June showed signs of slow deceleration to 3.3% while the core CPI reading fell sharply from 3.7% in May to 3.3% in June.

Earnings: American Express, Charles Schwab, 3M and Truist Financial beat top and bottom estimates today, adding to a positive week for earnings releases. However, the market reaction was mixed, with shares in 3M down 3.6% and Amex dropping 2.3% while Schwab gained 3%. There were no earnings releases after the close.

Corporate deals: British household products giant Reckitt Benckiser (mcap £34bn) has divested its Essential Home cleaning products business to private equity firm Advent International for an EV of up to $4.8bn, as the consumer goods company aims to concentrate its portfolio on faster-growing brands.

Credit Ratings: Moody’s upgraded Argentina’s ratings for both foreign-currency and local-currency debt by two notches, from Caa3 to Caa1, and the outlook was downgraded to stable, signalling enhanced confidence in Argentina's creditworthiness. Moody’s sees reforms and IMF support as reducing the likelihood of a default.

A recap of the ‘Crypto Week’ regulations passed by the US Congress yesterday: the Genius Act (Guiding and Establishing National Innovation for US Stablecoins Act), which establishes the first federal regulatory framework for stablecoins, mandating a 1:1 liquid reserve and enabling licensed issuers (banks, credit unions, fintechs) to operate stablecoins. The Anti-CBDC Surveillance State Act prevents the Fed from issuing a retail Central Bank Digital Currency. The Digital Asset Market Clarity Act, which still needs Senate approval, clearly defines jurisdiction for the SEC and CFTC, the latter gaining authority over “digital commodities”. The outcome explains the strong rally to all-time highs in the space.

Week ahead: Results from the Mag-7 tech giants will kick off on Wednesday, and the ECB meets on Thursday.

That’s all for this week. Enjoy your weekend.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.