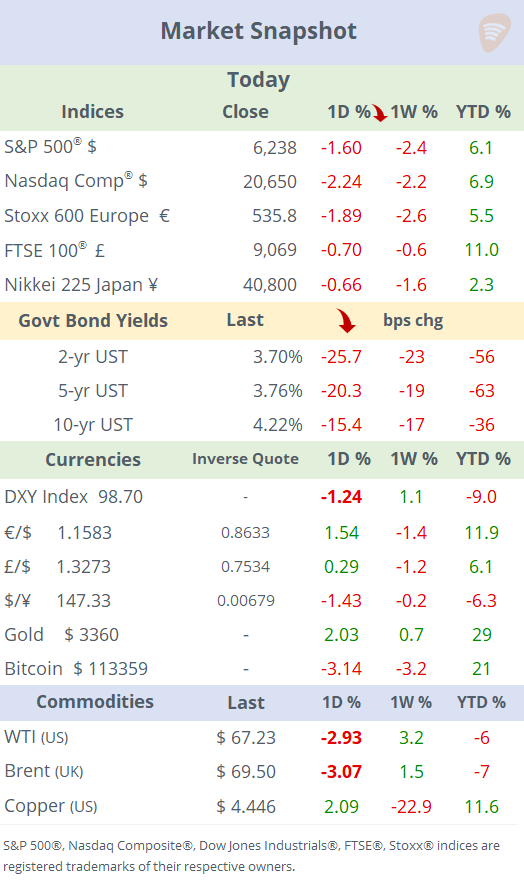

See the ‘Market Data’ post.

Good evening,

Friday’s broad market sell-off was fueled by a toxic mix of weak employment data and aggressive escalation in US trade policy. Investors responded by flying into safe-haven assets as recession risks and rate-cut expectations surged. Equities fell across regions and sectors, with U.S. benchmarks down around 2%, the worst day since April’s tariff sell-off. The dollar and crude oil also declined, Treasury yields plunged, the VIX index and gold rose.

The main catalyst for today’s decline was the weaker-than-expected non-farm payrolls report for July, which showed the U.S. economy added just 73,000 jobs, well below the 110,000 forecast. The BLS also revised the figures for June and May, cutting previously reported job gains by a combined 258,000. The unemployment rate ticked up slightly to 4.2%, in line with expectations. The update suggests the labour market is not as strong as previously believed. Trump ordered the firing of the head of the BLS, stating without evidence that the government’s jobs figures have been manipulated for political purposes.

On the trade front, Trump signed executive orders activating tariffs of 10% to 41% on imports from 70 countries, effective August 7. Notable hikes include Canada (up to 35%), Brazil, Taiwan, India, and Switzerland.

Traders’ expectations for a Fed quarter-point rate cut in September shifted sharply from a 38% probability yesterday to 85% today.

US Earnings: today’s earnings reports presented a mixed outlook; energy companies like Exxon and Chevron show resilience despite market challenges, while Colgate-Palmolive faces margin pressures. In contrast, Regeneron and Linde demonstrate strong growth, bolstering investor confidence. Stocks showed little price movement despite the broad selloff.

Central banks: In separate statements released this morning, Waller and Bowman, the two Fed officials who voted for a rate cut on Wednesday, said their decision was based on concerns about a weakening labour market. "I believe that the wait-and-see approach is overly cautious," Waller said. (WSJ)

Corporate Deals: Private equity firm Advent International has beaten KKR in a bidding war for Spectris Plc (mcap £4.05bn), after the British industrial group accepted its raised £4.8bn offer, one of the largest recent takeovers of a UK-listed firm. Spectris had agreed to a £4.4bn deal with Advent in June, before KKR made a rival £4.7bn bid last month. Spectris advanced 2.2% to a record high and accumulated a 63% gain YTD.

Goldman Sachs Asset Management is set to acquire British ice cream maker Froneri International, owned by Nestlé and PAI Partners, in a €15bn deal.

In the US oil & gas sector, MPLX LP (mcap $53bn) will buy Northwind Midstream for $2.4bn from private equity funds.

Wall Street boutique investment bank Perella Weinberg has agreed to acquire Devon Park Advisors, a secondary advisory firm and big player in private equity continuation-fund deals.

That’s all for this week. Enjoy your weekend.

Copyright © 2025 Succinct.

All rights reserved. This publication contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.